Discrimination: Employer's compensation completely tax-free

Under the General Equal Treatment Act (AGG), discrimination on grounds of race or ethnic origin, gender, religion or belief, disability, age, or sexual identity is prohibited (§ 1 AGG). If the prohibition of discrimination is violated, the employer is obliged to compensate for the resulting damage. The person affected can claim an appropriate monetary compensation (§ 15 para. 2 AGG). The question is how such compensation is treated for tax purposes. Recently, the Rhineland-Palatinate Fiscal Court ruled that compensation paid by an employer to an employee due to discrimination, bullying, or sexual harassment is tax-free and not taxable wages. This applies even if the employer denied the alleged discrimination and only agreed to the payment in a court settlement. Tax-free means that the payment is not subject to social security contributions (Rhineland-Palatinate Fiscal Court, 21.3.2017, 5 K 1594/14).

The case: An employee filed a unfair dismissal claim against the termination of her employment for "personal reasons", also seeking compensation for discrimination due to her disability. A few weeks before the dismissal, the Office for Social Affairs had determined a physical disability of 30%.

Before the Labour Court in Kaiserslautern, the employee and her employer reached a settlement in which "compensation according to § 15 AGG" of 10.000 Euro was agreed, and the employment relationship was terminated by mutual consent. The tax office wanted to treat the compensation as taxable wages.

According to the tax judges, the settlement reached at the Labour Court indicates that the payment was not compensation for material damages under § 15 para. 1 AGG (e.g. lost wages) but for non-material damages under § 15 para. 2 AGG due to discrimination against the claimant as a disabled person. Such compensation payments are tax-free and not to be classified as wages. The claimant's employer had denied the discrimination.

However, as part of the settlement, he was willing to pay compensation for (only) alleged discrimination. Such income does not have the character of wages and is therefore tax-free.

SteuerGo

The compensation is not only tax and social security-free, but it is also not included in the progression clause, so it does not lead to a higher tax rate for other income.

Altersdiskriminierende Besoldung?

The Federal Administrative Court has just awarded young civil servants compensation for age-discriminatory pay because their pay violated the prohibition of age discrimination. The court derived the entitlement to compensation from § 15 para. 2 AGG (Federal Administrative Court rulings of 6.4.2017, 2 C 11.16 and 2 C 12.16). The pay regulations disadvantaged younger civil servants solely because of their age (ECJ ruling of 19.6.2014, C-501/12).

Discrimination: Employer's compensation completely tax-free

How to save with a tax allowance in ELStAM!

Individuals with high income-related expenses, special expenses, or losses from other types of income (e.g. rental income, business operations, capital assets, etc.) pay too much income tax from their salary each month.

Only when the income tax return is completed can you reclaim the overpaid income tax from the tax office as part of the tax return.

With an application for income tax reduction, you can have the tax office enter an allowance for various tax deductions and your anticipated expenses in the electronic income tax deduction features (ELStAM). During payroll processing, your employer will then reduce your gross salary by the monthly allowance. As a result, income tax is calculated only on the reduced gross salary. This means you pay less tax, as well as less solidarity surcharge and church tax, during the year with an allowance.

How to save with a tax allowance in ELStAM!

How can I have the child allowance entered in the ELStAM?

The child allowance is granted retrospectively, but you can have it entered in your electronic wage tax deduction features (ELStAM). Although you will not pay less income tax in advance, the mid-year burden may still decrease. This is because the child allowance is taken into account when calculating church tax and the solidarity surcharge, which are then reduced. You must have the allowance entered at your tax office. You should bring the following documents:

- Identity card or passport

- Wage tax certificate

- Birth certificate

- If applicable, paternity recognition certificate if you are not married

- If applicable, certificate of life for children registered at a different address

The certificate of life must not be older than three years. If you cannot provide the certificate of life, e.g. because the child lives abroad, you must contact your tax office. The tax officer will enter the child allowance there.

Parents of children over 18 must also contact the tax office to have allowances entered.

How can I have the child allowance entered in the ELStAM?

How do I have allowances or changes entered in the ELStAM?

Taxpayers who wish to enter an allowance in their electronic payslip data (ELStAM) should contact the tax office. If you want to have a tax allowance for high work-related expenses taken into account, you can submit a corresponding application. The same applies to application-based deduction features, such as the consideration of adult children, foster children, tax class II for single parents.

Even if you have already used such an allowance in the previous year and the circumstances have not changed significantly, a new application for the new year is required. Only an already entered disability allowance will continue to be taken into account without a new application. The same applies if the disability allowance for a child has been transferred to the parents.

If the stored ELStAM are not correct, you must apply for a correction at the relevant local tax office. To do this, use the form "Correction application for electronic payslip data", which you can obtain from the tax office or online.

Caution

Since 1 January 2016, the tax allowance is generally valid for two years. If your circumstances change in your favour within the two years, you can have the allowance changed at the tax office. However, if your circumstances change to your disadvantage, you are obliged to have the allowance changed. A change may occur, for example, if you change employer, if the distance to your place of work or employment increases or decreases significantly, or if double housekeeping is established or ceases to exist (§ 39a para. 1 sentences 4-5 EStG).

How do I have allowances or changes entered in the ELStAM?

Voluntary resignation: Is the severance payment subject to the one-fifth rule?

Ending an employment relationship is often accompanied by a severance payment, especially if the employer terminates the contract. This severance payment may be tax-advantaged through the so-called one-fifth rule. But what applies if you resign yourself or if a termination agreement is initiated by you?

What is the one-fifth rule?

The one-fifth rule (§ 34 EStG) is a tax benefit for extraordinary income, which includes severance payments (§ 24 No. 1a EStG). It ensures that this income is taxed at a reduced rate to avoid excessive tax burdens due to the lump sum payment.

Conditions for the tax benefit

For the one-fifth rule to be applied, the severance payment must be related to an extraordinary event – typically termination by the employer or an amicable solution under pressure or conflict.

No tax benefit for voluntary resignation

Important: If you resign without external pressure or without prompting from the employer, the tax benefit will not be granted.

This applies in particular if you resign of your own accord without any conflict or financial hardship.

Exception: Termination agreement in a conflict situation

However, the Münster Finance Court has ruled that a tax benefit is also possible if the employee initiates the termination agreement themselves but acts under pressure:

- In the case decided, the employee was in conflict with the employer over their reclassification.

- They proposed the termination agreement themselves but acted to avoid further disputes.

- The court saw this as a sufficient conflict situation to justify the application of the one-fifth rule.

(FG Münster, 17.03.2017, Az. 1 K 3037/14 E, confirmed by BFH, judgment of 13.03.2018, IX R 16/17, BStBl 2018 II p. 709)

BFH confirms: No actual pressure required for amicable solution

The Federal Finance Court (BFH) clarified: If the employer and employee amicably terminate the employment relationship and a severance payment is made, it is not absolutely necessary for the employee to have been under recognisable pressure. The amicable solution itself is sufficient for the tax benefit.

When does the tax benefit lapse despite severance pay?

The BFH ruled in another judgment (06.12.2021, IX R 10/21):

- If a severance payment is not paid in one year but spread over several years, the one-fifth rule lapses.

- This also applies if there are partial payments (e.g. severance pay and starting bonus) made for the same event.

Special case: Sprint bonus

A so-called sprint bonus, paid when an employee voluntarily leaves early, can be considered compensation and subject to the one-fifth rule.

(Hessian FG, court order of 31.05.2021, Az. 10 K 1597/20)

Conclusion

Even on your own initiative, a severance payment can be tax-advantaged – the decisive factor is the actual conflict situation or an amicable solution between the parties. However, it is important that the payment is made in one year and recognised as compensation.

Voluntary resignation: Is the severance payment subject to the one-fifth rule?

How much is the church tax?

The amount of church tax depends on your place of residence. In Bavaria and Baden-Württemberg, it is 8% of the assessed income tax, and in the other federal states, it is 9%. The calculation is based on the assessed income tax.

Withholding tax:

Church tax is also taken into account at the same rate within the framework of the withholding tax. If you have income from business operations or income taxed under the partial income procedure, the taxable income (zvE) for the calculation of church tax is determined separately.

Church tax and child allowances:

- Example without child allowance: You live in Berlin and have a gross monthly salary of 3.000 Euro in tax class IV. Your monthly church tax is 28,51 Euro.

- Example with two child allowances: You live in Berlin and have a gross monthly salary of 3.000 Euro in tax class IV. Your monthly church tax is now 9,74 Euro.

If child allowances are entered in your ELStAM (electronic wage tax deduction features), the monthly income tax is not reduced, only the church tax and the solidarity surcharge. This applies regardless of whether you receive child benefit during the year.

Child allowances in income tax assessment:

Child allowances reduce the taxable income only if the tax advantage is higher than the child benefit. However, for the calculation of church tax and solidarity surcharge, the allowances are taken into account fictitiously.

Advantage:

Even if children are only considered for part of the year (e.g. when finishing education or at birth), the full child allowance and BEA allowance are credited for the calculation of church tax and solidarity surcharge.

How much is the church tax?

How are short-time work benefits and maternity pay taxed?

Short-time allowance and maternity pay are tax-free but subject to the progression clause. This means that these wage replacement benefits are used to determine the tax rate, even though they are not taxed themselves. The progression clause can lead to an increase in your tax rate and thus the tax burden on your taxable income.

How does the progression clause affect my tax rate?

Although wage replacement benefits such as short-time allowance and maternity pay are tax-free, they are added to your income to calculate your personal tax rate. This results in a higher tax rate, which is then applied to your actual taxable income. This may mean that you have to pay additional taxes or receive a lower tax refund.

Example: Progression clause in practice

A single mother earns 26.000 Euro gross per year and receives an additional 6.000 Euro parental allowance:

- Total income: 32.000 Euro

- Determined tax rate: 15.24%

- Tax only on 26.000 Euro income: 3.962 Euro

- Without progression clause: Tax only 3.195 Euro

Result: Due to the parental allowance, 767 Euro more tax is payable – even though it is tax-free. Church tax and possibly the solidarity surcharge may also increase.

Impact on the basic allowance:

If your income, including wage replacement benefits, exceeds the basic allowance, the increased tax rate will be applied. If the total income is below the basic allowance, the wage replacement benefits remain tax-free.

Tip for repayment of wage replacement benefits:

If you have to repay overpaid unemployment benefit or short-time allowance, you should submit a tax return. The repayment can reduce your tax rate (negative progression), which may result in a tax refund.

Employer supplements to short-time allowance:

Many employers top up the short-time allowance to 80% or more. These top-up amounts were temporarily tax-free, provided they did not exceed 80% of the last net salary together with the short-time allowance (Corona Tax Assistance Act, until 30.06.2022). Since July 2022, employer supplements to short-time allowance are taxable again.

How are short-time work benefits and maternity pay taxed?

Are there wage replacement benefits that I won't find on my income tax statement?

Yes. Wage replacement benefits that you do not receive from your employer are also not shown on your income tax statement.

Wage or income replacement benefits include in particular:

- Unemployment benefit I,

- Short-time work allowance and seasonal short-time work allowance,

- Insolvency benefit in the event of employer insolvency,

- Parental allowance under the Federal Parental Allowance and Parental Leave Act,

- Maternity benefit, maternity benefit supplement,

- Sickness, injury, and transitional benefits for disabled persons or comparable wage replacement benefits,

- Top-up amounts and partial retirement bonuses under the Partial Retirement Act or civil service law,

- Wage subsidies for older employees from the employment agency.

Important: All wage or income replacement benefits subject to the progression clause must be entered exclusively in the main tax form and no longer in Form N since 2015. You can find the section in SteuerGo under "Other details > Income replacement benefits".

Are there wage replacement benefits that I won't find on my income tax statement?

What can I deduct for employer benefits for commuting to work?

1. Basic principles of the tax treatment of employer subsidies

Many employers contribute to the costs of commuting to work. The tax implications depend on how this support is structured.

Employer subsidies for travel between home and the primary workplace are generally considered taxable income. However, the legislator allows special tax simplifications: The employer can tax such subsidies at a flat rate of 15 percent income tax (§ 40 para. 2 sentence 2 EStG). In this case, the subsidies are exempt from social security contributions.

For the employee, this means: The subsidy does not increase the taxable gross salary and does not need to be declared as income in the tax return.

If the employee receives tax-free or flat-rate taxed employer benefits, the travel allowance is reduced by the employer's reimbursements (§ 9 para. 1 sentence 3 no. 4 sentence 5 EStG).

2. Tax-free employer benefits

Since 2019, certain employer benefits for commuting can be completely tax and social security-free. The condition is that they are paid in addition to the salary already owed, i.e. not through a salary conversion.

The tax exemption applies to:

- Travel between home and primary workplace,

- Travel to a meeting point specified by the employer,

- Travel in a large-scale work area (§ 9 para. 1 no. 4a sentence 3 EStG).

Examples: If the employer pays 30 Euro per month for a public transport monthly ticket in addition to the salary, this amount remains tax-free. A job ticket for travel to a port area is also tax-free if the use is documented accordingly.

3. Which means of transport are subsidised?

The tax exemption does not apply to all means of transport, but only to certain ones.

Subsidised are in particular:

- Public transport in regular service: ICE, IC, EC, regional trains, long-distance buses, underground, trams, buses

- Also private journeys on public transport are subsidised if covered by flat-rate tickets

The Deutschlandticket is tax-free if the employer's subsidy is in addition to the salary.

Not subsidised:

- Taxis (except in licensed regular service)

- Chartered buses for individual journeys

- Air travel

Note: A taxi is not considered a subsidised public transport (BFH, judgement of 09.06.2022 – VI R 26/20).

4. Job ticket & benefits in kind

The monetary value of a job ticket is not counted towards the 50 Euro exemption limit for benefits in kind (§ 8 para. 2 sentence 11 EStG). This exemption limit can therefore be used additionally.

Subsidised are, among others:

- Free or discounted tickets (e.g. monthly tickets, BahnCard 100)

- Subsidies for tickets purchased by the employee

- Free rides for certain occasions (e.g. smog alert)

5. Travel allowances for journeys with your own car

Employer subsidies for journeys with your own car are not tax-free. However, they can be taxed at a flat rate of 15 percent (§ 40 para. 2 sentence 2 EStG).

This applies:

- Taxable, but can be taxed at a flat rate of 15% (§ 40 para. 2 sentence 2 EStG)

- Exempt from social security contributions if taxed at a flat rate

- Reduction of the travel allowance is required

Example: If the employer pays 100 Euro per month as a car allowance and taxes it at a flat rate, the amount remains tax-free for the employee. However, the travel allowance is reduced accordingly in the tax return.

6. Travel allowance despite employer benefits

The travel allowance can still be claimed:

- 0.30 Euro per kilometre for the first 20 kilometres

- 0.38 Euro from the 21st kilometre

If the employee receives tax-free or flat-rate taxed subsidies, this allowance is reduced.

Important: The travel allowance only has an effect if the total work-related expenses exceed the employee allowance of 1.230 Euro (2025).

7. Company car and travel allowance

The travel allowance can also be claimed when using a company car, provided the monetary value for travel between home and the primary workplace is taxed (e.g. according to the 0.03 percent rule).

If the employer taxes this additional value at a flat rate of 15 percent, the travel allowance can still be claimed as work-related expenses. However, other tax-free or flat-rate taxed employer benefits reduce the travel allowance if they relate to the same journeys.

8. Price advantages from third parties

If employees receive discounts from a third party, these are tax-free if:

- the third-party company has a self-economic interest,

- the discounts are also granted to other third parties,

- or the granting of the discount is predominantly in the interest of the employer.

Such benefits are taxable, however, if the employer actively participates in granting them or if the benefit is clearly related to the employment relationship.

Conclusion: Which option is advantageous?

Whether an employer subsidy is tax-efficient depends primarily on the distance to the workplace and the type of employer benefit.

Both tax-free and flat-rate taxed subsidies of 15 percent lead to a reduction of the travel allowance. An individual comparison calculation is therefore recommended.

What can I deduct for employer benefits for commuting to work?

What is a pension?

Pension payments play a special role in income tax. Many people receive payments in retirement that do not come from the statutory pension insurance – for example, a civil service pension or a company pension. But what exactly are pension payments, how are they taxed, and what is meant by the so-called pension allowance? In this article, we explain the most important points clearly and concisely.

What are pension payments?

Pension payments are regular payments you receive after the end of an active employment relationship – a kind of "replacement" for wages. They are usually paid by the former employer or a pension scheme and are considered income from employment for tax purposes.

Typical examples of pension payments:

- Civil service pensions

- Company pensions

- Transitional payments for early retirement

- Widow's or widower's pensions from the former employer

Important: Pension payments are not to be confused with the statutory pension. The statutory old-age pension falls under "other income" and is declared under pension income. Pension payments, on the other hand, are considered employment income.

How are pension payments taxed?

Pension payments are generally subject to income tax. However, not the entire amount is taxed – there are tax benefits in the form of allowances.

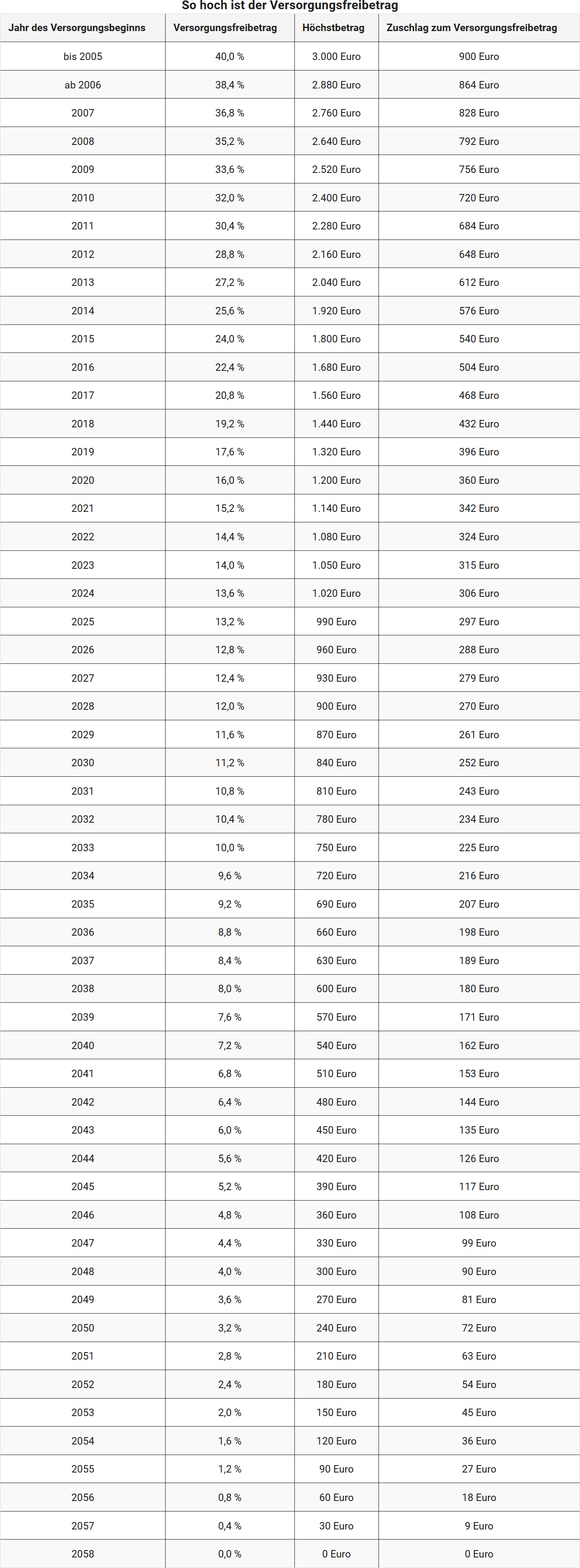

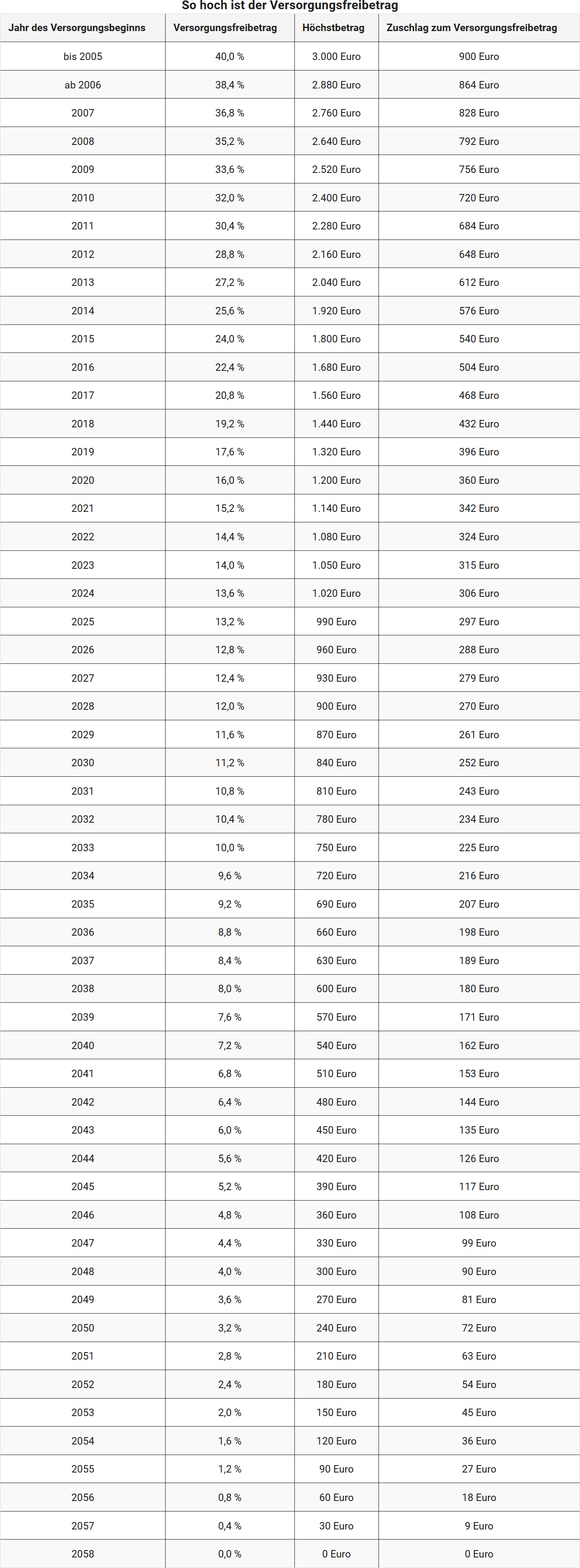

Pension allowance

The state grants a certain percentage of pension payments tax-free – this is the pension allowance. Its amount depends on the year you first received pension payments.

For anyone receiving pension payments for the first time in 2025, the following applies:

- 13.2 percent of the annual pension payments are tax-free,

- but a maximum of 990 Euro.

Surcharge to the pension allowance

In addition to the percentage allowance, a fixed surcharge is granted. For first receipt in 2025, this amounts to 297 Euro per year.

The allowance remains fixed as long as the payments continue. However, it is only granted once, for the first pension payment received.

Multiple pension payments – what to consider?

If you receive multiple pension payments, such as a civil service pension and an additional company pension, you must declare all payments in full in your tax return. It is important to note:

- The pension allowance and surcharge are only granted once, for the first pension payment received.

- Further pension payments are fully taxable, unless they are payments with their own entitlement, such as from another employment relationship.

Tip: Check your electronic payslip to see how many pension payments are listed. Employers or pension schemes report the amounts with a special code for the tax office.

Special features of survivor's pensions

Survivors, such as widows or widowers, can also receive pension payments – for example, in the form of a survivor's pension from the deceased's former employer.

The same tax rules generally apply to these pension payments, including the pension allowance and surcharge. However, the allowance may be reduced proportionally, for example, if the original recipient had already exhausted this allowance.

Important: If you receive a statutory survivor's pension (e.g. from the German Pension Insurance), this is not a pension payment. In this case, you must declare the pension in form R.

Example: How taxation works

Ms Meier retires in January 2025 and receives a civil service pension of 30.000 Euro per year. Since she receives pension payments for the first time in 2025, the following allowances apply:

13.2 percent of 30.000 Euro = 3.960 Euro → Maximum amount limited to 990 Euro

Surcharge to the pension allowance → 297 Euro

Total allowance: 990 Euro + 297 Euro = 1.287 Euro

The taxable part of the payments is therefore → 30.000 Euro – 1.287 Euro = 28.713 Euro

Note: The tax office automatically takes the allowance into account, provided the payslip is correctly completed.

Conclusion

Pension payments are tax-advantaged – but only partially. The pension allowance and surcharge make part of the payments tax-free, the rest is subject to regular taxation. Anyone receiving multiple pension payments or a survivor's pension should carefully check how much is actually taxable. By providing complete and correct information in the tax return, you avoid queries and benefit from the possible allowances.

What is a pension?

Are my pension payments taxable?

Yes, your pension payments are generally taxable. According to the Income Tax Act, they are considered income from employment and are subject to the wage tax deduction procedure. This means that income tax is automatically deducted at the time of payment.

What is included in pension payments?

Pension payments include, in particular:

- Pension (e.g. civil service pension)

- Widow's or widower's pension

- Orphan's pension

- Maintenance contributions

- Similar benefits

How does taxation work?

The taxation of pension payments is generally the same as for a regular employment relationship. Since 2013, the paying office (e.g. pension office) retrieves your electronic wage tax deduction features (ELStAM) from the tax authorities using your tax identification number and date of birth.

However, there is an important difference: a pension allowance is granted for pension payments. This reduces the taxable income.

What is the pension allowance?

The pension allowance is an annually determined tax-free portion of your pension payments. In addition, a fixed supplement to the pension allowance is granted. The amount of these allowances depends on the year in which you first receive pension payments.

With the introduction of the Pension Income Act (AltEinkG) on 01.01.2005, a gradual transition to so-called subsequent taxation began. This means that instead of contributions to pension schemes, the later benefits – i.e. pension payments and pensions – are increasingly taxed.

The transition period lasts until 2040. After that, civil service pensions and pensions will be treated completely equally for tax purposes – the pension allowance will then be completely abolished.

How are the allowances developing?

The pension allowance and the supplement decrease every year for new pension recipients. So those who retire later receive a lower allowance. From 2040 onwards, no pension allowance will be granted.

The decisive factor is the year of first receipt of pension payments. This determines:

- the applicable percentage,

- the maximum amount of the pension allowance, and

- the supplement to the pension allowance.

These values are regulated in the table to § 19 para. 2 Income Tax Act (EStG).

Is the allowance permanent?

Yes. The pension allowance and the supplement, once determined, apply for life – regardless of whether the amount of your pension payments changes due to regular adjustments.

When is the allowance recalculated?

The allowance is only recalculated if your pension payments change due to offsetting, suspension, reduction or increase (e.g. due to legal regulations).

In the calendar year in which the pension payment changes, the highest allowances possible under § 19 EStG apply.

What is the standard allowance for income-related expenses?

For pension payments – as with pensions – a standard allowance for income-related expenses of 102 Euro per year applies, which is automatically taken into account. Only if you can prove higher work-related expenses is it worth providing individual proof.

Are my pension payments taxable?

Severance Pay and the One-Fifth Rule – Key Information on Tax Treatment

The termination of employment can be accompanied by a severance payment for employees. This one-off payment is taxable, but under certain conditions, it can be taxed at a reduced rate using the one-fifth rule.

Entitlement to severance pay after redundancy

According to Section 1a of the Employment Protection Act (KSchG), employees are legally entitled to severance pay in the event of redundancy if they do not file an unfair dismissal claim. The amount is usually based on the length of service:

- 0.5 months' salary per year of employment

Example: For 10 years of service, the severance pay is 5 months' salary.

Benefits in kind (e.g. company car or laptop) can also be included in the calculation.

Different regulations apply to settlement or termination agreements, especially if initiated by the employee.

How does the one-fifth rule work?

The one-fifth rule under Section 34 of the Income Tax Act (EStG) reduces the tax burden on extraordinary income (e.g. severance payments). Since the Tax Amendment Act 2001, the tax office automatically checks whether the application is more favourable.

Note: If the one-fifth rule is applied, there is an obligation to submit a tax return.

This is how the tax liability is calculated with the one-fifth rule

- The taxable part of the extraordinary income (severance pay, jubilee bonus, remuneration for multi-year work, etc.) is deducted from the taxable income.

- The income tax is calculated for the remaining taxable income according to the applicable tax rate.

- The severance payment is divided by 5 and one-fifth is added to the remaining taxable income.

- The income tax is then calculated for the total according to the tax rate.

- The difference between the two tax amounts is calculated and multiplied by 5.

- The result is the income tax on the extraordinary income.

Example: A married employee receives a severance payment of 50.000 Euro in 2025. The remaining taxable income is 70.000 Euro.

- Tax on 70.000 Euro: 11.850 Euro

- Tax on 80.000 Euro: 14.990 Euro

- Difference: 3.140 Euro

- Tax on severance payment: 3.140 Euro × 5 = 15.700 Euro

- Total tax: 11.850 Euro + 15.700 Euro = 27.550 Euro

One-fifth rule also possible with voluntary termination agreement

The one-fifth rule can also apply to an amicable termination of contract, even if initiated by the employee. This was confirmed by the Federal Fiscal Court (BFH) in its ruling of 13.03.2018 (Ref. IX R 16/17, BStBl 2018 II p. 709). Specific external pressure no longer needs to be established.

End of the one-fifth rule in the payroll tax procedure from 2025

Since 01.01.2025, the application of the one-fifth rule is no longer possible in the payroll tax deduction procedure. This was decided as part of the bureaucracy reduction through the Growth Opportunities Act (from 27.03.2024). Employers no longer carry out checks and calculations. The one-fifth rule is only considered as part of the tax return.

Severance Pay and the One-Fifth Rule – Key Information on Tax Treatment

Severance payment and one-fifth rule: When does the reduced tax rate apply?

In the event of early termination of employment, employees often receive a severance payment. Since 2006, this is no longer subject to a tax allowance, but it can still be taxed at a reduced rate under the so-called fifth rule (§ 34 EStG) – under certain conditions.

Conditions for applying the fifth rule

For the reduced taxation to apply, the following conditions must be met:

- The severance payment is paid in a lump sum in one calendar year.

- The annual income with severance payment must be higher than the income that would have been earned if the employment had continued uninterrupted.

The aim of this regulation is to mitigate the progressive effect of the income tax rate when exceptionally high income is received in one year due to the severance payment.

No tax advantage for low severance payment

The fifth rule does not apply automatically. This is shown by a ruling of the Federal Fiscal Court on 08.04.2014 (Az. IX R 33/13):

With a gross salary in the previous year of around 140.000 Euro and a severance payment of 43.000 Euro, there is no “lump sum” increase in income.

→ The fifth rule is not applicable.

Reason: The income in the severance year was not higher than if the employment had continued as normal. Therefore, there was no progressive tax disadvantage.

Comparison calculation: “Actual amount” vs. “Target amount”

Whether the fifth rule is applicable is checked by means of a comparison calculation:

- Actual amount: Actual income in the year of the severance payment (including severance payment)

- Target amount: Fictional income if employment had continued until the end of the year (e.g. based on the previous year's income)

Note:

If the severance payment does not exceed the lost income until the end of the year, further income may be taken into account that would not have been received without the termination of employment – e.g. unemployment benefit.

Example:

Mr M. ended his employment in June 2025 and received a severance payment of 35.000 Euro. His regular annual income would have been 70.000 Euro.

In the severance year, he only earns 25.000 Euro in wages plus the severance payment. The total income is 60.000 Euro – and thus below the income if he had continued working without interruption.

The fifth rule cannot be applied as there is no progressive disadvantage.

Severance payment and one-fifth rule: When does the reduced tax rate apply?

What are remunerations for multi-year work?

A payment or advance payment for multi-year employment (e.g. severance payments) can be taxed at a reduced rate in the year of payment using the five-year method. The key factor is that the employment spans two calendar years.

The so-called five-year rule benefits extraordinary income under German tax law (§ 34 EStG). These so-called "income subject to preferential tax rates" are income earned over several years but realised and taxed in a single year.

What are remunerations for multi-year work?