How do I submit my tax return to the tax office?

You submit your tax data securely and encrypted directly to the tax office – either with your personal Elster certificate or the portal certificate from SteuerGo.

Submission in paper form has not been possible since the 2021 tax year. The tax return must be submitted electronically – complete and without a signature.

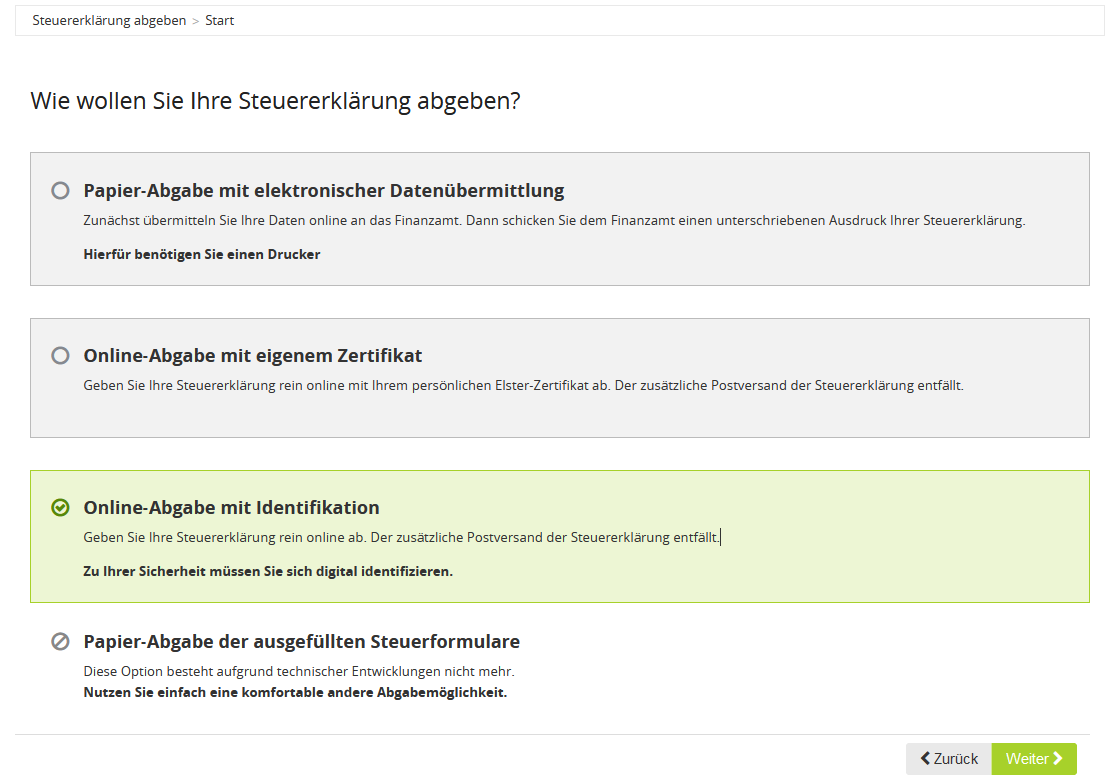

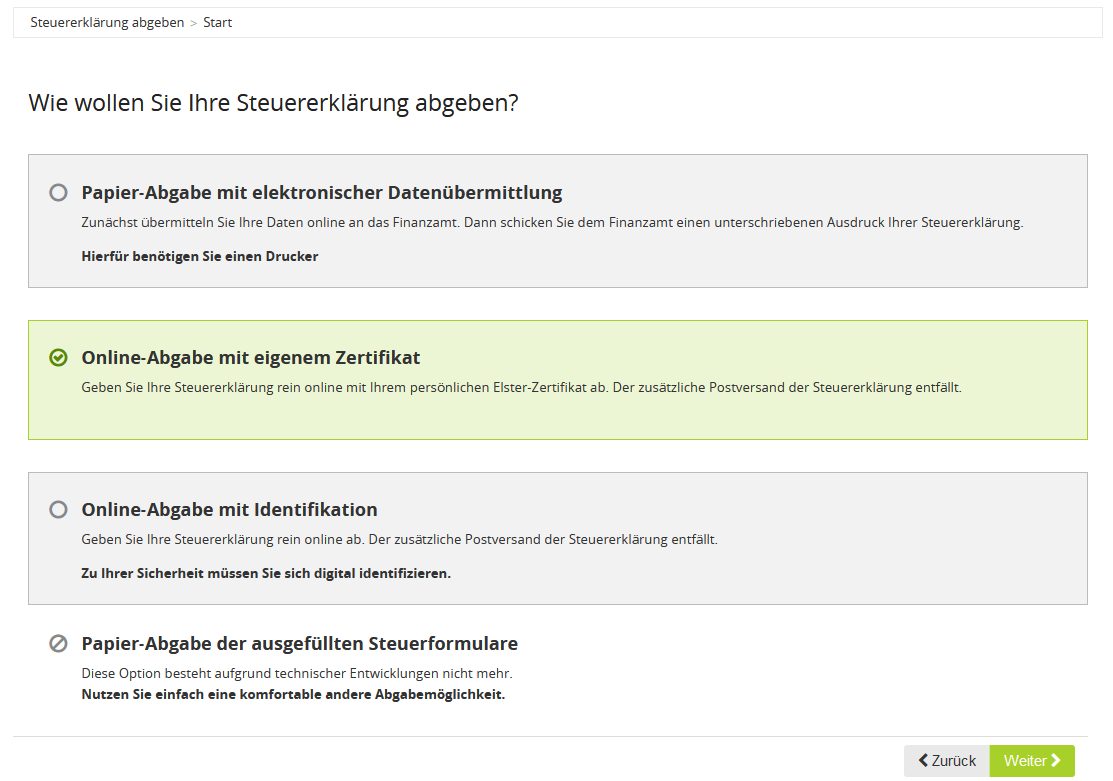

Overview of submission types

- Online submission with own certificate

You send your tax return completely digitally with your Elster certificate. No postal delivery is required.

- Online submission with identification

Electronic submission is also possible without your own certificate – completely without printing and signing.

Further information

- The chosen submission type has no impact on the costs at SteuerGo.

- SteuerGo will automatically inform you if legally required documents need to be submitted separately.

How do I submit my tax return to the tax office?

Online submission with identification

With online submission with identification, SteuerGo securely and encryptedly transfers your tax data directly to the tax office via the ELSTER interface (SSL connection).

As your data is processed electronically by the administration, a simplified tax return is possible: You usually need to submit fewer documents than with the paper submission.

Identification required before submission

A digital identification is legally required for you to submit the declaration in an authenticated manner (see § 87d Fiscal Code).

SteuerGo is obliged to verify your identity and address before data transfer. Various digital identification methods are available for this purpose.

After submission

After successful submission, you will receive:

- a confirmation of receipt as proof that your tax return has been received by the tax office,

- as well as the compressed tax return as a PDF to document the submitted data.

Document requests by the tax office

If the tax office requests additional documents, you can conveniently submit them directly after submission via the electronic document submission of SteuerGo – without postal delivery.

Online submission with identification

Online submission with your own certificate

With online submission using a personal certificate, SteuerGo transfers your tax data directly to the tax office via the ELSTER interface – securely and encrypted via SSL connection.

As the processing is fully electronic, a simplified tax return is possible: You usually need to submit fewer documents than with the traditional submission.

Requirement: Personal ELSTER certificate

For paperless submission, you need a free certificate from the tax authorities. It enables authenticated transmission – a signed printout is no longer required. You can apply for the certificate exclusively at www.elster.de.

After submission

After successful submission, you will receive:

- a confirmation of receipt as proof of the transmission of your data,

- as well as the compressed tax return as a PDF document for your records.

Request for documents by the tax office

If the tax office requests documents, you can conveniently submit them using the electronic document submission (online document submission) function – without postal delivery. SteuerGo provides this function directly after submission.

Online submission with your own certificate

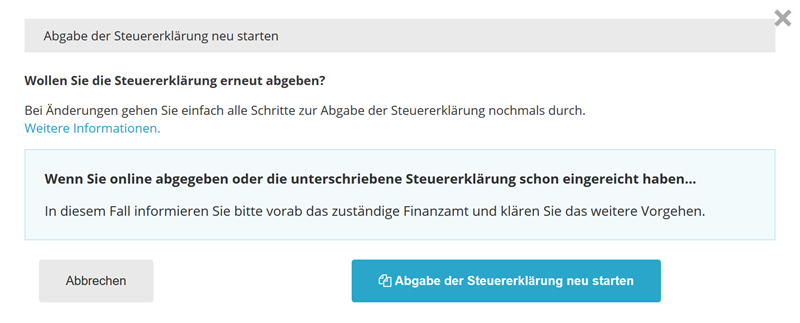

Do you want to resubmit your income tax return?

If you have discovered an error in your tax return, you can correct it even after submission. How you proceed depends on whether and how your return has already been submitted to the tax office.

Case 1: Tax return not yet submitted to the tax office

No problem – you can adjust your data in SteuerGo at any time and resubmit the tax return electronically.

The tax office automatically processes the most recently submitted version of your return. No separate notification to the tax office is required.

Case 2: Tax return already submitted electronically (certified or with identification)

In this case, you can also resubmit your tax return to the tax office.

Tip: Inform your local tax office by phone in advance that you are sending a corrected return. This will prevent your original tax case from being processed or the notice being issued.

Case 3: Tax assessment notice already received

If you have already received a tax assessment notice, resubmission is no longer sufficient. In this case, you must formally appeal against the notice to allow for a correction.

You can find a corresponding template in our sample letters under the title: “Appeal due to error”.

Questions or support?

Our customer service will be happy to assist you: hilfe@steuergo.de

We will also be happy to call you back if you wish.

Do you want to resubmit your income tax return?

What should I do if the submission fails?

If you encounter repeated errors when submitting your tax return, please contact our customer service at hilfe@steuergo.de and provide the following information:

- Does the system display an error message? If so, please provide a brief description.

- Date and time when the error occurred

- Browser used (e.g. Firefox, Chrome, Edge – ideally with version number)

- Operating system used (e.g. Windows, macOS, Linux)

Note: For optimal use of SteuerGo, we recommend the latest versions of

Mozilla Firefox or Google Chrome.

What should I do if the submission fails?