What is a pension?

Pension payments play a special role in income tax. Many people receive payments in retirement that do not come from the statutory pension insurance – for example, a civil service pension or a company pension. But what exactly are pension payments, how are they taxed, and what is meant by the so-called pension allowance? In this article, we explain the most important points clearly and concisely.

What are pension payments?

Pension payments are regular payments you receive after the end of an active employment relationship – a kind of "replacement" for wages. They are usually paid by the former employer or a pension scheme and are considered income from employment for tax purposes.

Typical examples of pension payments:

- Civil service pensions

- Company pensions

- Transitional payments for early retirement

- Widow's or widower's pensions from the former employer

Important: Pension payments are not to be confused with the statutory pension. The statutory old-age pension falls under "other income" and is declared under pension income. Pension payments, on the other hand, are considered employment income.

How are pension payments taxed?

Pension payments are generally subject to income tax. However, not the entire amount is taxed – there are tax benefits in the form of allowances.

Pension allowance

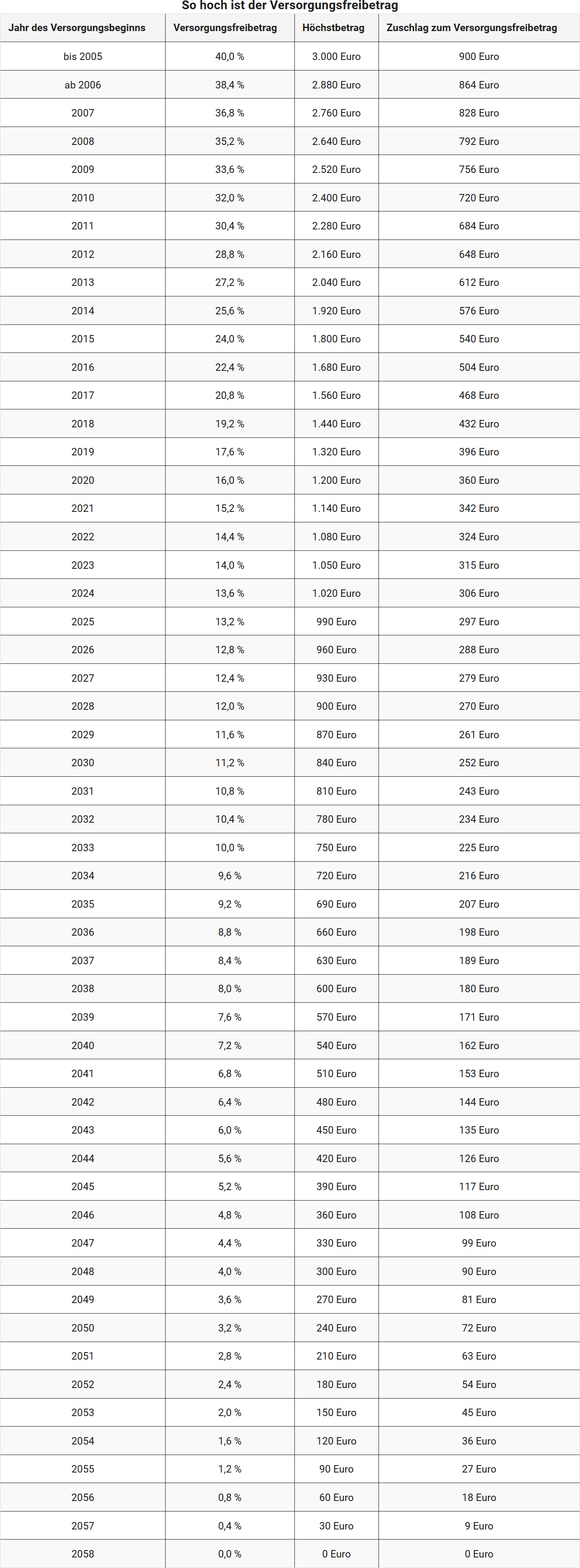

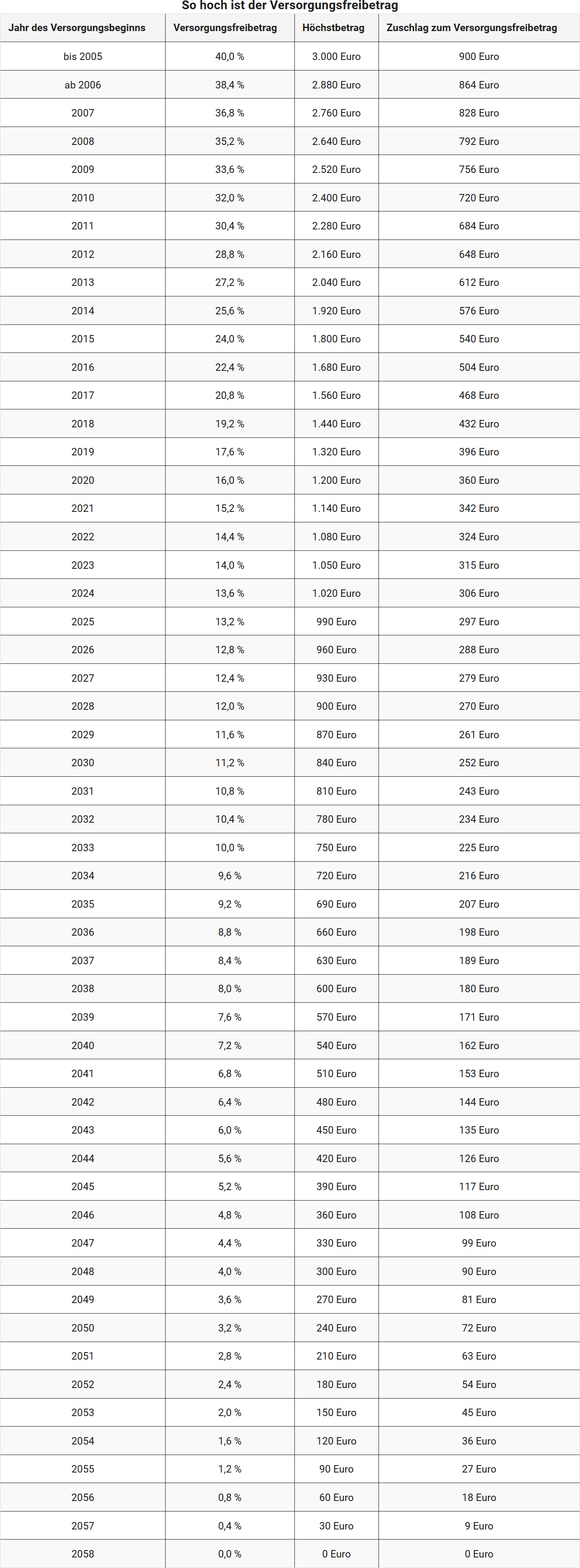

The state grants a certain percentage of pension payments tax-free – this is the pension allowance. Its amount depends on the year you first received pension payments.

For anyone receiving pension payments for the first time in 2025, the following applies:

- 13,6 percent of the annual pension payments are tax-free,

- but a maximum of 1.020 Euro.

Surcharge to the pension allowance

In addition to the percentage allowance, a fixed surcharge is granted. For first-time receipt in 2025, this amounts to 306 Euro per year.

The allowance remains fixed as long as the payments continue. However, it is only granted once, for the first pension payment received.

Multiple pension payments – what to consider?

If you receive multiple pension payments, such as a civil service pension and an additional company pension, you must declare all payments in full in your tax return. It is important to note:

- The pension allowance and surcharge are only granted once, for the first pension payment received.

- Further pension payments are fully taxable, unless they are payments with their own entitlement, such as from another employment relationship.

Tip: Check your electronic payslip to see how many pension payments are listed. Employers or pension schemes report the amounts with a special code for the tax office.

Special features for survivors' pensions

Survivors, such as widows or widowers, can also receive pension payments – for example, in the form of a survivor's pension from the deceased's former employer.

The same tax rules generally apply to these pension payments, including the pension allowance and surcharge. However, the allowance may be reduced proportionally, for example, if the original recipient had already used up this allowance.

Important: If you receive a statutory survivor's pension (e.g. from the German Pension Insurance), this is not a pension payment. In this case, you must declare the pension in Annex R.

Example: How taxation works

Ms Meier retires in January 2025 and receives a civil service pension of 30.000 Euro per year. Since she receives pension payments for the first time in 2025, the following allowances apply:

- Pension allowance: 13,6 percent of 30.000 Euro = 4.080 Euro

- Surcharge: 306 Euro

- Total allowance: 4.080 Euro + 306 Euro = 4.386 Euro

The taxable part of the payments is: 30.000 Euro – 4.386 Euro = 25.614 Euro

Ms Meier must declare this amount in the tax return (Annex N). The tax office automatically takes the allowance into account, provided the payslip is correctly completed.

Conclusion

Pension payments are tax-advantaged – but only partially. The pension allowance and surcharge make part of the payments tax-free, the rest is subject to regular taxation. Anyone receiving multiple pension payments or a survivor's pension should carefully check how much is actually taxable. By providing complete and correct information in the tax return, you avoid queries and benefit from the possible allowances.

What is a pension?

Are my pension payments taxable?

Yes, your pension payments are generally taxable. According to the Income Tax Act, they are considered income from employment and are subject to the wage tax deduction procedure. This means that income tax is automatically deducted at the time of payment.

What is included in pension payments?

Pension payments include, in particular:

- Pension (e.g. civil service pension)

- Widow's or widower's pension

- Orphan's pension

- Maintenance contributions

- Similar benefits

How does taxation work?

The taxation of pension payments is generally the same as for a regular employment relationship. Since 2013, the paying office (e.g. pension office) retrieves your electronic wage tax deduction features (ELStAM) from the tax authorities using your tax identification number and date of birth.

However, there is an important difference: a pension allowance is granted for pension payments. This reduces the taxable income.

What is the pension allowance?

The pension allowance is an annually determined tax-free portion of your pension payments. In addition, a fixed supplement to the pension allowance is granted. The amount of these allowances depends on the year in which you first receive pension payments.

With the introduction of the Pension Income Act (AltEinkG) on 01.01.2005, a gradual transition to so-called subsequent taxation began. This means that instead of contributions to pension schemes, the later benefits – i.e. pension payments and pensions – are increasingly taxed.

The transition period lasts until 2040. After that, civil service pensions and pensions will be treated completely equally for tax purposes – the pension allowance will then be completely abolished.

How are the allowances developing?

The pension allowance and the supplement decrease every year for new pension recipients. So those who retire later receive a lower allowance. From 2040 onwards, no pension allowance will be granted.

The decisive factor is the year of first receipt of pension payments. This determines:

- the applicable percentage,

- the maximum amount of the pension allowance, and

- the supplement to the pension allowance.

These values are regulated in the table to § 19 para. 2 Income Tax Act (EStG).

Is the allowance permanent?

Yes. The pension allowance and the supplement, once determined, apply for life – regardless of whether the amount of your pension payments changes due to regular adjustments.

When is the allowance recalculated?

The allowance is only recalculated if your pension payments change due to offsetting, suspension, reduction or increase (e.g. due to legal regulations).

In the calendar year in which the pension payment changes, the highest allowances possible under § 19 EStG apply.

What is the standard allowance for income-related expenses?

For pension payments – as with pensions – a standard allowance for income-related expenses of 102 Euro per year applies, which is automatically taken into account. Only if you can prove higher work-related expenses is it worth providing individual proof.

Are my pension payments taxable?