Are my pension payments taxable?

Yes, your pension payments are generally taxable. According to the Income Tax Act, they are considered income from employment and are subject to the wage tax deduction procedure. This means that income tax is automatically deducted at the time of payment.

What is included in pension payments?

Pension payments include, in particular:

- Pension (e.g. civil service pension)

- Widow's or widower's pension

- Orphan's pension

- Maintenance contributions

- Similar benefits

How does taxation work?

The taxation of pension payments is generally the same as for a regular employment relationship. Since 2013, the paying office (e.g. pension office) retrieves your electronic wage tax deduction features (ELStAM) from the tax authorities using your tax identification number and date of birth.

However, there is an important difference: a pension allowance is granted for pension payments. This reduces the taxable income.

What is the pension allowance?

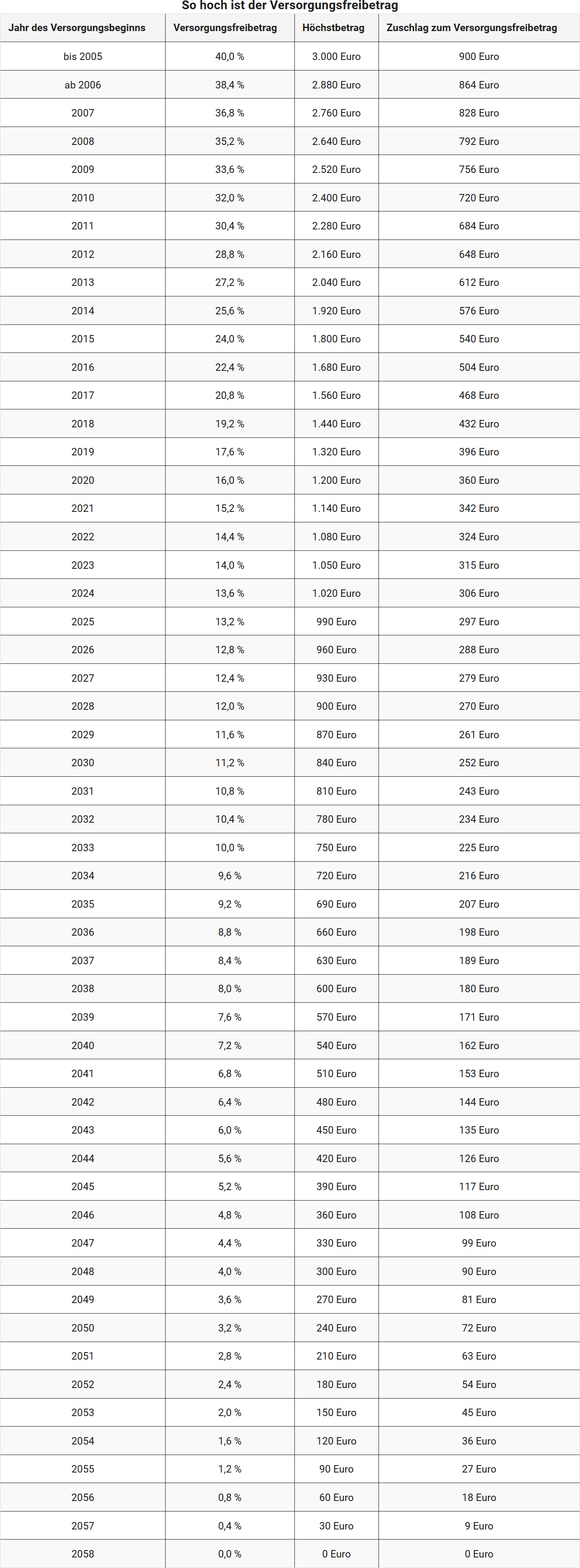

The pension allowance is an annually determined tax-free portion of your pension payments. In addition, a fixed supplement to the pension allowance is granted. The amount of these allowances depends on the year in which you first receive pension payments.

With the introduction of the Pension Income Act (AltEinkG) on 01.01.2005, a gradual transition to so-called subsequent taxation began. This means that instead of contributions to pension schemes, the later benefits – i.e. pension payments and pensions – are increasingly taxed.

The transition period lasts until 2040. After that, civil service pensions and pensions will be treated completely equally for tax purposes – the pension allowance will then be completely abolished.

How are the allowances developing?

The pension allowance and the supplement decrease every year for new pension recipients. So those who retire later receive a lower allowance. From 2040 onwards, no pension allowance will be granted.

The decisive factor is the year of first receipt of pension payments. This determines:

- the applicable percentage,

- the maximum amount of the pension allowance, and

- the supplement to the pension allowance.

These values are regulated in the table to § 19 para. 2 Income Tax Act (EStG).

Is the allowance permanent?

Yes. The pension allowance and the supplement, once determined, apply for life – regardless of whether the amount of your pension payments changes due to regular adjustments.

When is the allowance recalculated?

The allowance is only recalculated if your pension payments change due to offsetting, suspension, reduction or increase (e.g. due to legal regulations).

In the calendar year in which the pension payment changes, the highest allowances possible under § 19 EStG apply.

What is the standard allowance for income-related expenses?

For pension payments – as with pensions – a standard allowance for income-related expenses of 102 Euro per year applies, which is automatically taken into account. Only if you can prove higher work-related expenses is it worth providing individual proof.