Field help:

(2022)

Additional meal expenses

Additional meal expenses

Enter here the deductible meals allowances incurred in connection with external work, business trips or double household running for company-related reasons.

- Travel expenses to be indicated separately on the page "Vehicle costs and other travel expenses".

- Accommodation costs and additional travel expenses must be entered on the page "Other unlimited deductible business expenses".

- Travel expenses for employees are entered on the page "General operating expenses" under "Expenses for own personnel".

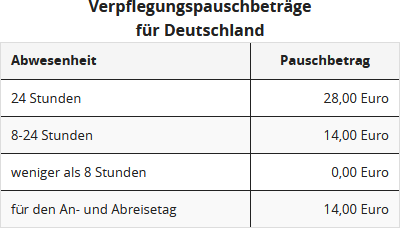

You can only deduct a flat-rate amount for additional meals expenses, not the actual costs. The amount of the flat rates depends on the duration of your absence from your home and company. The meal allowance for business trips within Germany with an absence duration of

For business trips abroad, you can deduct the country-specific meal allowances.

If an external work assignment begins on one day and ends on the following day after more than 8 hours without overnight accommodation, a meal allowance of 14 Euro is granted for the day with the prevailing absence (sect. 9 para. 4a no. 3 of the Income Tax Act (EStG)).