Erhalte ich eine Empfangsbestätigung für die Abgabe meiner Steuererklärung?

Nachdem Sie mit SteuerGo Ihre Steuererklärung elektronisch an Ihr Finanzamt übermittelt haben, erhalten Sie eine Empfangsbestätigung, die unter anderem die folgenden Informationen enthält:

- Transferticket

- Telenummer

- Sendedatum

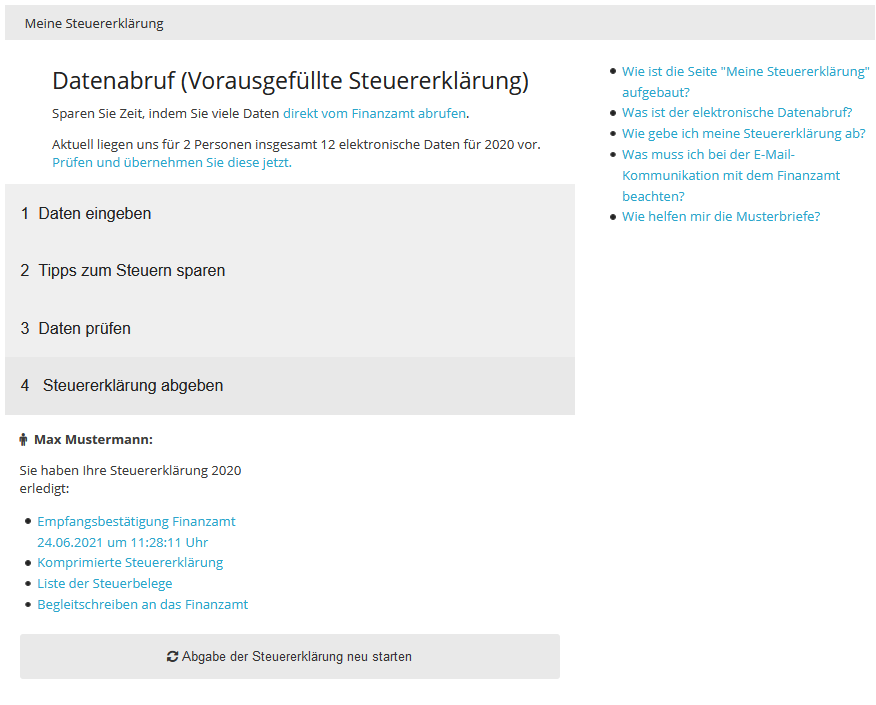

Die Empfangsbestätigung steht nach dem elektronischen Versand auch in Ihrem persönlichen Bereich auf SteuerGo zusammen mit der komprimierten Steuererklärung als PDF-Datei für Sie bereit.

Mit Transferticket und Telenummer bestätigt das Finanzamt den elektronischen Empfang Ihrer Steuerdaten.

Wichtig

Bei der Wahl der Papier-Abgabe mit elektronischer Datenübermittlung wird die Steuererklärung allerdings erst im Finanzamt bearbeitet, wenn Sie die Steuererklärung ausgedruckt und unterschrieben per Post eingereicht haben.

Erhalte ich eine Empfangsbestätigung für die Abgabe meiner Steuererklärung?

Welche Daten werden von SteuerGo gespeichert?

SteuerGo speichert nach dem elektronischen Versand für Sie die Empfangsbestätigung (Sendebericht) sowie die komprimierte Steuererklärung, die nach dem Versand an die Finanzverwaltung als Nachweis für die korrekte elektronische Übermittlung Ihre Daten erstellt wird.

Beide Dokumente werden aus Datenschutzgründen verschlüsselt gespeichert, können aber jederzeit in Ihrem persönlichen Bereich eingesehen werden.

Welche Daten werden von SteuerGo gespeichert?

Wie lange darf die Bearbeitung der Steuererklärung beim Finanzamt dauern?

Leider gibt es keine Frist, innerhalb derer das Finanzamt Ihre Steuererklärung bearbeiten muss! Erfahrungswerte zeigen, dass die Bearbeitung in der Regel zwischen 2 und 3 Monaten dauern kann.

Im Zweifelsfall kann es sinnvoll sein, telefonisch bei Ihrem zuständigen Sachbearbeiter nachzuhaken.

Wichtig: Auch das Finanzamt kann sich für Ihre Steuererklärung nicht beliebig lange Zeit lassen. Vergehen seit der Abgabe der Steuererklärung mehr als sechs Monate, ohne dass das Finanzamt tätig wird, haben Sie die Möglichkeit einen sogenannten Untätigkeitseinspruch einzureichen. Diesen legen Sie bei Ihrem Finanzamt ein (§ 347 Abs. 1 Satz 2 AO).

Wie lange darf die Bearbeitung der Steuererklärung beim Finanzamt dauern?

Wie kann ich bereits abgeschickte Daten ändern?

Wenn Sie Ihre Steuererklärung bereits elektronisch an das Finanzamt übermittelt haben, aber noch einige Angaben ändern müssen, ist das kein Problem. Schicken Sie einfach die Daten erneut per ELSTER ans Finanzamt.

Durch die individuelle Telenummer sind die neuen Daten mit der dann ebenfalls neu erstellten komprimierten Steuererklärung fest verbunden. Das bedeutet, dass der Bearbeiter im Finanzamt nur die von Ihnen gesendeten Daten bearbeiten kann, die mit der von Ihnen eingereichten Steuererklärung übereinstimmen. Die zuvor gesendeten Daten - wie viele auch immer - werden automatisch gelöscht.

Wichtig

Reichen Sie immer die komprimierte Steuererklärung bei Ihrem Finanzamt ein, die zu den zuletzt per ELSTER gesendeten Daten gehört. Nur dann ist gewährleistet, dass der Sachbearbeiter die Daten zu Ihrem Steuerfall auch von den Servern des Finanzamts abrufen kann.

Wie kann ich bereits abgeschickte Daten ändern?

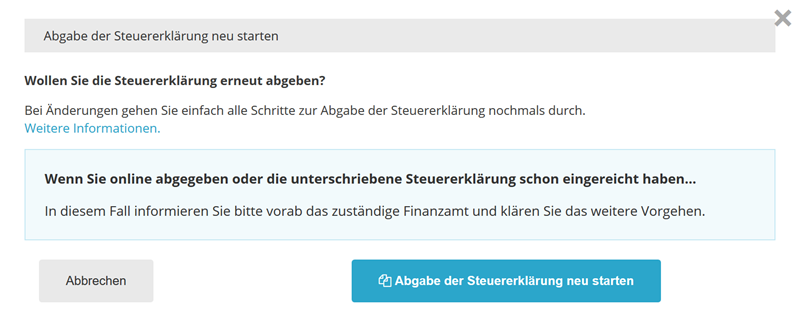

Sie wollen Ihre Einkommensteuererklärung erneut abgeben?

Fall 1: Steuererklärung noch nicht beim Finanzamt eingereicht

Sollten Sie einen Fehler in Ihrer Steuererklärung gefunden haben, ist dies grundsätzlich kein Problem. Sie können Ihre Steuererklärung jederzeit auf SteuerGo ändern und erneut elektronisch an Ihr Finanzamt senden. Das Finanzamt wird die jeweils letzte, also die dann aktuellste Version bearbeiten. Damit Ihre Steuererklärung bearbeitet werden kann, ist es erforderlich, die ausgedruckte und unterschriebene Erklärung ans Finanzamt zu senden. Nur so werden Ihre per ELSTER übertragenen Daten vom Finanzbeamten abgerufen und bearbeitet. Wenn Sie Ihre Steuererklärung nicht an das Finanzamt schicken, werden Ihre Daten spätestens nach sechs Monaten automatisch gelöscht.

Fall 2: Unterschriebene Steuererklärung bereits an das Finanzamt versendet

In diesem Fall können Sie Ihre Steuererklärung problemlos erneut online an Ihr Finanzamt übermitteln und danach die aktualisierte komprimierte Erklärung unterschrieben einreichen. Hierzu reicht es aus, Ihrem Finanzamt eine schriftliche Mitteilung beizulegen. Ein entsprechendes Anschreiben finden Sie bei unseren Musterbriefen ("Erneute Abgabe Einkommensteuererklärung").

Wenn Sie bereits die unterschriebene Steuererklärung eingereicht haben, informieren Sie am besten vorab per Telefon das zuständige Finanzamt, dass Sie eine korrigierte Version Ihrer Steuererklärung übersenden wollen. So verhindern Sie, dass sich die erneute Abgabe der Steuererklärung und der Versand des Steuerbescheids durch das Finanzamt überschneiden.

Fall 3: Steuererklärung rein online abgegeben

Auch in diesem Fall können Sie Ihre Steuererklärung erneut elektronisch zertifiziert an Ihr Finanzamt übermitteln. Informieren Sie am besten vorab per Telefon das zuständige Finanzamt, dass Sie eine korrigierte Version Ihrer Steuererklärung übersenden wollen. So verhindern Sie, dass sich die erneute Abgabe der Steuererklärung und der Versand des Steuerbescheids durch das Finanzamt überschneiden.

Fall 4: Steuerbescheid Ihres Finanzamts liegt bereits vor

Wurde Ihnen bereits der Steuerbescheid von Ihrem Finanzamt übersandt, müssen Sie gegen Steuerbescheid Einspruch einlegen. Nur dann kann eine Korrektur Ihres Steuerbescheids erfolgen. Auch hierzu bieten wir Ihnen ein entsprechendes Musterschreiben ("Einspruch wegen Irrtums") an.

Kundenservice

Bei weiteren Fragen setzen Sie sich mit unserem Kundenservice (hilfe@steuergo.de) in Verbindung. Auf Ihren Wunsch hin rufen wir Sie auch gerne telefonisch zurück.

Sie wollen Ihre Einkommensteuererklärung erneut abgeben?