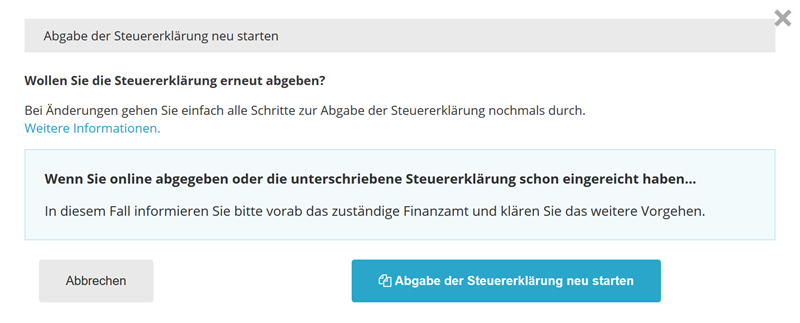

Do you wish to resubmit your income tax return?

Case 1: Tax return not yet submitted to the tax office

If you have found an error in your tax return, this is generally not a problem. You can change your tax return at any time on SteuerGo and resubmit it electronically to your tax office. The tax office will process the latest version. For your tax return to be processed, it is necessary to send the printed and signed declaration to the tax office. Only then will the data you transmitted via ELSTER be retrieved and processed by the tax officer. If you do not send your tax return to the tax office, your data will be automatically deleted after six months.

Case 2: Signed tax return already sent to the tax office

In this case, you can easily resubmit your tax return online to your tax office and then submit the updated compressed declaration with your signature. It is sufficient to include a written note to your tax office. You can find a corresponding cover letter in our sample letters ("Resubmission of income tax return").

If you have already submitted the signed tax return, it is best to inform the relevant tax office in advance by telephone that you wish to submit a corrected version of your tax return. This will prevent the resubmission of the tax return from overlapping with the dispatch of the tax assessment notice by the tax office.

Case 3: Tax return submitted purely online

In this case, you can also resubmit your tax return electronically certified to your tax office. It is best to inform the relevant tax office in advance by telephone that you wish to submit a corrected version of your tax return. This will prevent the resubmission of the tax return from overlapping with the dispatch of the tax assessment notice by the tax office.

Case 4: Tax assessment notice from your tax office already received

If you have already received the tax assessment notice from your tax office, you must lodge an objection to the tax assessment notice. Only then can your tax assessment be corrected. We also offer a corresponding sample letter for this ("Objection due to error").

If you have any further questions, please contact our customer service (hilfe@steuergo.de). If you wish, we will also call you back.

Bewertungen des Textes: Sie wollen Ihre Einkommensteuererklärung erneut abgeben?

3.34

von 5

Anzahl an Bewertungen: 151