Herzlichen Glückwunsch!

Sie haben die Eingaben für die Steuererklärung 2024 abgeschlossen.

Im nächsten Schritt erhalten Sie auf Basis Ihrer Angaben Tipps für diese Steuererklärung.

Danach geben Sie die Steuererklärung ab. Zum Schluss können Sie auch Belege online an das Finanzamt senden.

Dieser Text bezieht sich auf die

. Die Version die für die

What is the deadline for submitting my tax return?

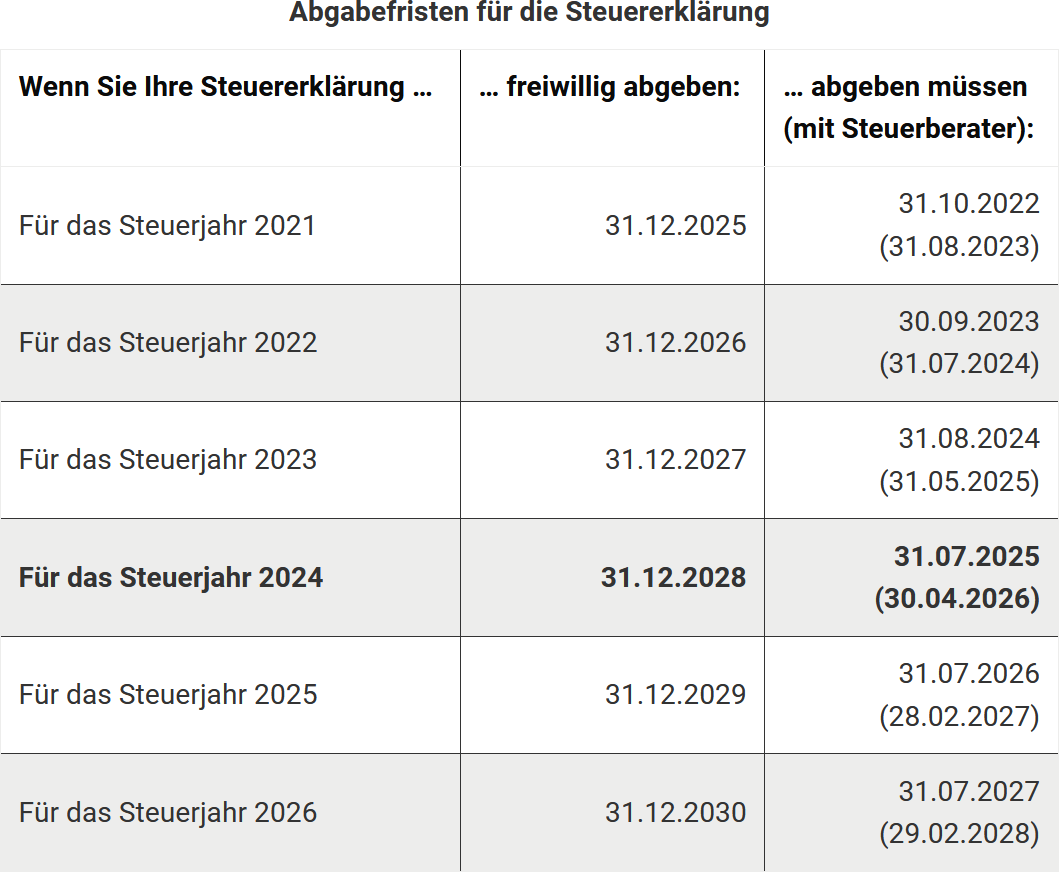

Submission deadlines for the 2024 tax return

Self-prepared tax return:

The regular submission deadline is 31 July 2025. There is no automatic extension for 2024.

Prepared by a tax advisor or income tax assistance association:

In this case, the deadline is automatically extended to 30 April 2026.

Submission deadlines for the tax return

Early request by the tax office

The tax office may request an earlier submission in individual cases. In this case, be sure to meet the individually set deadline to avoid late fees.

Application for deadline extension

If you cannot submit the return on time, apply for an extension before 31 July 2025. Approval is at the discretion of the tax office and should be well justified (e.g. illness, stay abroad, missing documents).

Consequences of missing the deadline

After the deadline, you will usually receive a reminder with a new submission date. If you still do not submit, fines and penalties may be imposed.

Deadline for voluntary submission

For a voluntary tax return (without obligation to submit), the deadline is 31 December 2028. However, early submission can lead to a faster tax refund.

(2024): What is the deadline for submitting my tax return?