Field help:

(2022)

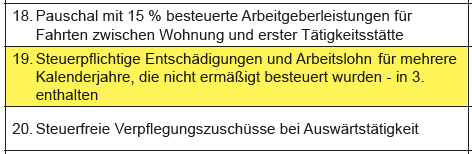

19.Indemnities / wages for several calendar years

Enter the following amount from your employment tax statement:

Number 19:

"Taxable indemnities and wages for several years that have not been taxed at a reduced rate included in 3."

Note: The amount of compensation and wages for several calendar years that were not taxed at a reduced rate on the basis of the fifth regulation by the employer is entered here. A most favourable rate test is carried out for this income as part of the income assessment in order to determine whether the fifth regulation can be applied to this income. Relevant documents (employment contract, resignation letter or dissolution contract) should be submitted to the tax office as proof.