How do I submit my tax return to the tax office?

You submit your tax data securely and encrypted directly to the tax office – either with your personal Elster certificate or the portal certificate from SteuerGo.

Submission in paper form has not been possible since the 2021 tax year. The tax return must be submitted electronically – complete and without a signature.

Overview of submission types

- Online submission with own certificate

You send your tax return completely digitally with your Elster certificate. No postal delivery is required.

- Online submission with identification

Electronic submission is also possible without your own certificate – completely without printing and signing.

Further information

- The chosen submission type has no impact on the costs at SteuerGo.

- SteuerGo will automatically inform you if legally required documents need to be submitted separately.

How do I submit my tax return to the tax office?

Who is required to submit a tax return?

Whether you are required to submit an income tax return for the year 2025 depends on your personal situation. In many cases, there is no obligation – however, there are exceptions. The legal basis is § 46 Income Tax Act (EStG).

When is there an obligation to submit?

A tax return is mandatory if:

- You received wage replacement benefits (e.g. parental allowance, sickness benefit, unemployment benefit) of over 410 Euro per year (progression clause),

- You had multiple simultaneous employments where one was taxed under tax class VI,

- You and your spouse or civil partner chose the tax class combination III/V or IV with factor,

- You had additional income of over 410 Euro (e.g. from self-employment, rental, capital gains without withholding tax or pensions),

- You were requested to submit by the tax office.

Detailed information on the mandatory assessment for employees can be found here: Obligation to submit a tax return.

When is there no obligation to submit?

Submission is generally not required if:

- You were employed by one employer only in 2025,

- You were classified in tax class I,

- You had no wage replacement benefits or additional income,

- none of the special cases mentioned apply.

Tip: Voluntary submission can be worthwhile

Even without an obligation, a so-called application assessment can be worthwhile. Many employees receive an average refund of over 1.000 Euro – for example, due to work-related expenses, special expenses or exceptional burdens that were not taken into account in the wage tax deduction.

When in doubt: Ask the tax office

If you are unsure whether you need to submit, your local tax office can help.

Who is required to submit a tax return?

How can I amend data that has already been submitted?

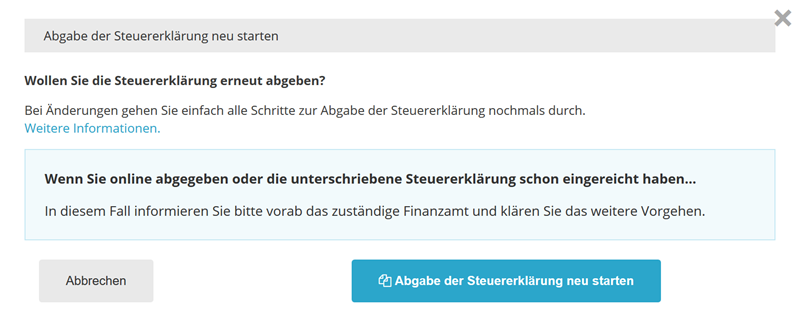

If you wish to make changes to your tax return after submitting it electronically, you can resubmit the return to the tax office via SteuerGo at any time – of course, free of charge.

To do this, click on “Submit tax return” in the menu and then on the button “Restart submission of tax return”.

Adjust the desired information and resubmit your tax return.

Important: The tax office will automatically consider the most recently submitted version of your return.

A signature or paper submission is no longer required for authenticated submissions.

How can I amend data that has already been submitted?