How is the statutory pension taxed?

Since the Retirement Income Act of 2005, state pensions have been taxed according to the principle of deferred taxation. This means that part of the pension is taxable, while the rest remains tax-free. The taxable portion depends on the year of retirement.

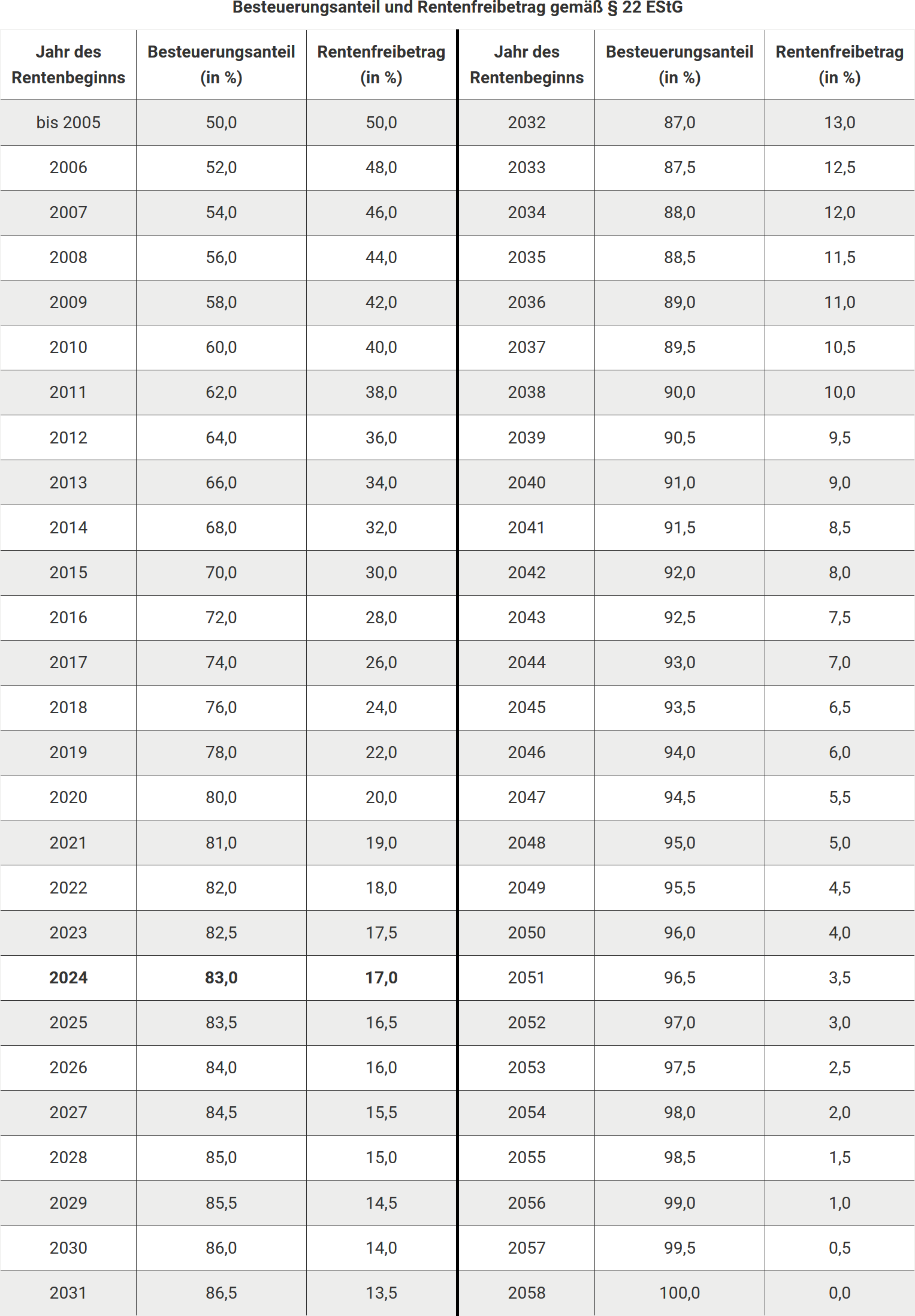

Taxation percentage:

- Retirement before 2005: 50% tax-free portion.

- Retirement 2005 to 2024: The taxable portion increases each year. For 2024, it is 83%.

- Retirement from 2025: The portion increases annually by 0.5 percentage points and reaches 100% from 2058.

Calculation of the pension allowance:

- In the first and second year of retirement, the pension is taxed with the fixed taxable portion.

- From the third year, the pension allowance remains constant and unchanged for life.

- Pension increases are fully taxable from the third year.

Hans Müller retired in 2009 and received a pension of 12.000 Euro in 2023. With a taxable portion of 58%, 6.960 Euro are taxable. His allowance is 5.040 Euro. As long as his income is below the basic allowance of 11.784 Euro (2024), he does not have to submit a tax return.

Income-related expenses:

- The tax office automatically deducts an income-related expenses allowance of 102 Euro.

- Higher expenses (e.g. tax advice or pension advice) can be claimed but must be proven.

If Mr Müller only retires in 2024 and receives an annual pension of 15.000 Euro, 12.450 Euro would be taxable (83%). Since he exceeds the basic allowance, he would have to submit a tax return.

Important: The pension allowance remains the same even if the pension is adjusted and refers to a fixed amount. Future pension increases must therefore be fully taxed.

Bewertungen des Textes: How is the statutory pension taxed?

5.00

von 5

Anzahl an Bewertungen: 2