(2024)

How can I claim work clothing as work-related items?

You can deduct expenses for work clothing from your taxes. However, you must note that not all clothing worn during work is considered work clothing. If the clothing can also be worn outside of work, it is not considered work clothing for tax purposes. If private use of the clothing is possible (as with everyday clothing), you cannot deduct the expenses as work-related expenses.

Work clothing must be typical workwear that is designed and necessary for professional use due to its nature and characteristics.

The following work clothing is recognised:

- Protective clothing of any kind (e.g. work coats, lab coats, work shoes, work boots, safety shoes),

- Uniforms and service clothing with service badges,

- Official attire (judges, prosecutors, lawyers, clergy)

- Sportswear for sports teachers

- Uniformly coloured suits and costumes for airline employees,

- White work clothing for doctors,

You can deduct the actual proven purchase costs for tax purposes. If the conditions for the deductibility of work clothing are met, you can also claim the cleaning costs.

In previous rulings, the Federal Fiscal Court has recognised the following civilian clothing as work clothing: black suit for an undertaker (BFH ruling of 30.9.1970, I R 33/69), black suit and black trousers for a head waiter (BFH ruling of 9.3.1979, VI R 171/77), black suit for a Catholic clergyman (BFH ruling of 10.11.1989, VI R 159/86).

However, the Federal Fiscal Court has now changed its previous legal opinion and no longer recognises a black suit for a funeral orator as work clothing. The ruling will also affect other professional groups. A black suit that does not differ in any way from what a large part of the population wears as formal clothing on special occasions is not typical work clothing. The clothing can be used at any time for private formal occasions. This applies to all professions, including certain professional groups such as funeral orators, undertakers, Catholic clergy, and head waiters (BFH ruling of 16.3.2022, VIII R 33/18).

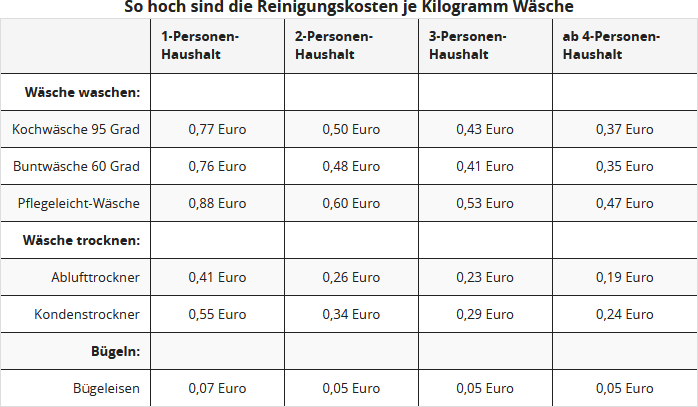

If you wash your work clothing yourself, you can estimate the costs. For the cleaning of work clothing, the tax authorities and the courts recognise the use of consumer association experience values (ruling of the Baden-Württemberg Finance Court, 3 K 202/04). The Consumer Association Working Group e.V., Bonn, has determined the costs for a wash cycle, based on one kg of laundry (as of Dec 2002):

To calculate the proportional annual costs for the care of "typical work clothing" from the table, multiply the above amounts (Euro/kg) in the respective treatment type by the annual amount (kg) of typical work clothing to be cleaned. Example: As a single person, with 40 wash cycles per year, each with 3 kg of boil wash at 0.77 Euro and 2 kg of easy-care wash at 0.88 Euro, you come to a total of 163 Euro deductible cleaning costs (92.40 Euro plus 70.40 Euro).

Important: The average calculation includes the purchase price of the washing machine, a maintenance allowance, and operating costs such as electricity, water, and detergent. According to the BFH, an annual flat rate for cleaning costs is not permitted.

Bewertungen des Textes: How can I claim work clothing as work-related items?

5.00

von 5

Anzahl an Bewertungen: 9