Tax return 2024: What's new

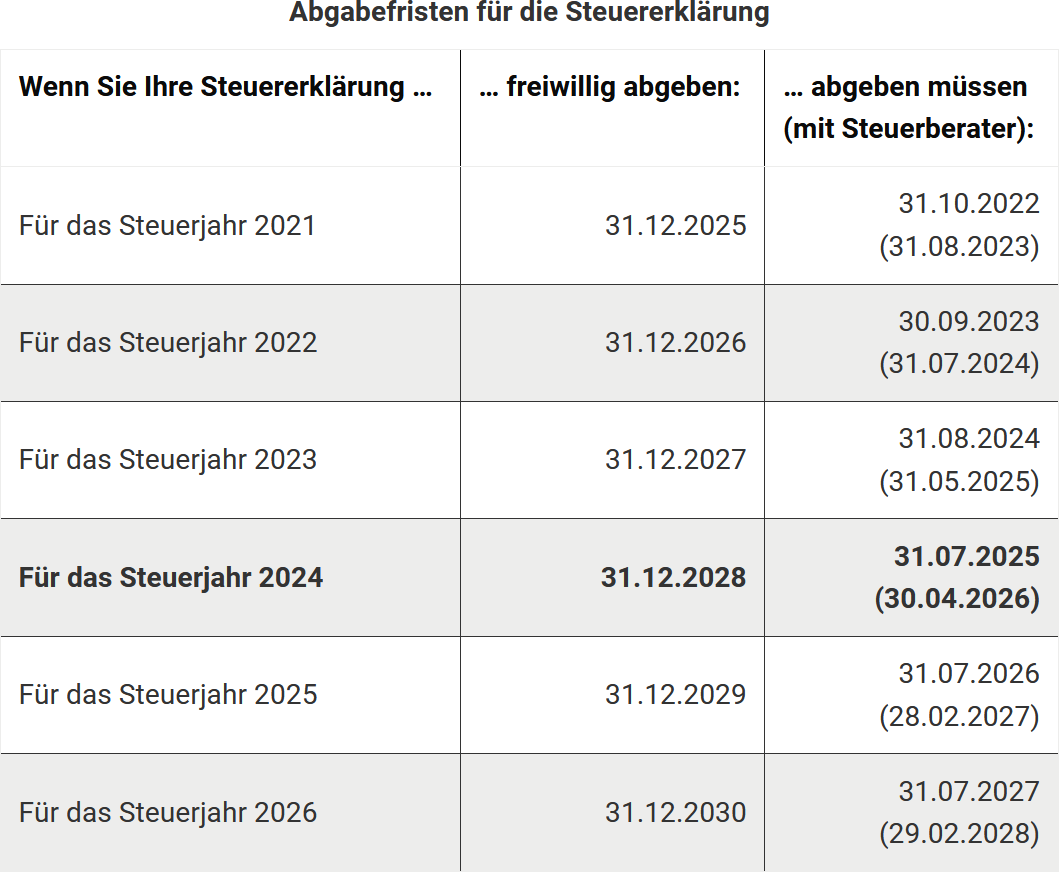

Submission deadline for the 2024 tax return

You are required to submit an income tax return if there is a specific reason. This is known as a mandatory assessment or official assessment.

The tax return for 2024 must be submitted by 31 July 2025 in the case of a mandatory submission, with an extension until 30 April 2026 if a tax advisor is engaged. For voluntary submissions (application assessment, § 46 para. 2 no. 8 EStG), you have until 31 December 2028 without any late fees (§ 169 AO).

The following deadlines apply:

Tax relief: Increase in basic allowance

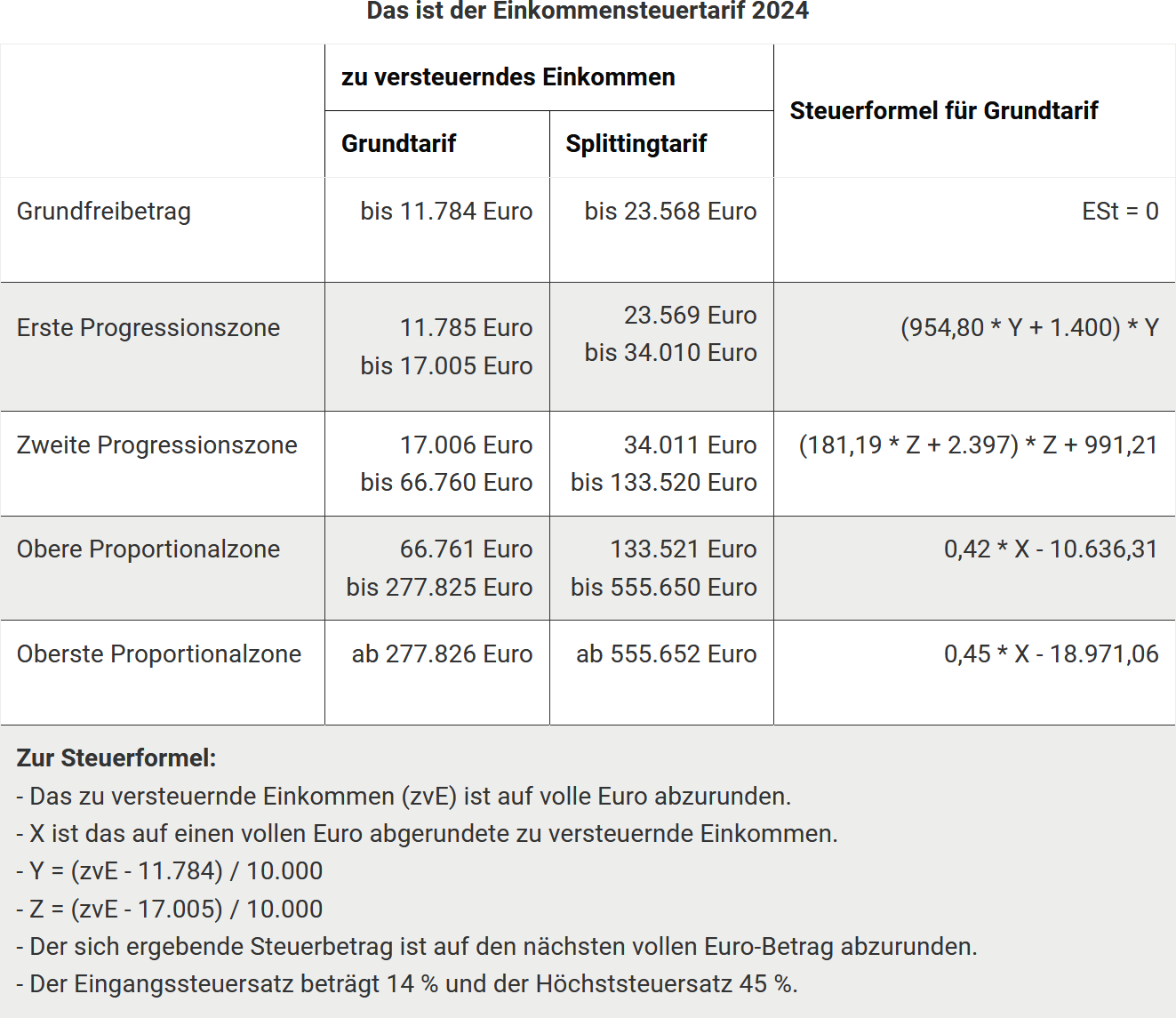

The tax basic allowance ensures that the portion of income absolutely necessary for living expenses is not taxed (minimum subsistence level). As of 1 January 2024, the basic allowance has been increased to 11,784 Euro. Further increases are planned for 2025 (12,084 Euro) and 2026 (12,336 Euro) ("Tax Development Act", § 32a EStG).

Is the allowance for 2023 and 2024 too low?

The basic allowance is 10,908 Euro in 2023 and is expected to be 11,784 Euro in 2024. The Schleswig-Holstein Finance Court ruled that these amounts are not unconstitutional but allowed an appeal (BFH, III R 26/24). The plaintiffs criticised that the tax basic allowance is below social benefits (e.g. citizens' income), which constitutes a violation of the constitutionally protected minimum subsistence level.

Practical tip: Objections to tax assessments for 2023 and 2024 can be suspended (§ 363 para. 2 AO).

Reduction of fiscal drag

To avoid a creeping tax increase, the key figures of the tax rate will be adjusted by 6.3% (2024), 2.5% (2025) and 2% (2026). As a result, higher tax rates will only apply to higher incomes.

The new income tax rate 2024

Wealth tax applies only at higher income levels

Since 2007, there has been a so-called wealth tax, a tax surcharge of 3 percentage points for top earners. The top tax rate is therefore 45% in the highest proportional zone. The wealth tax remains unchanged from 2024: For taxable income of 277,826 Euro (single) or 555,651 Euro (married), the top tax rate of 45% applies (§ 32a para. 1 no. 5 EStG).

Family support 2024

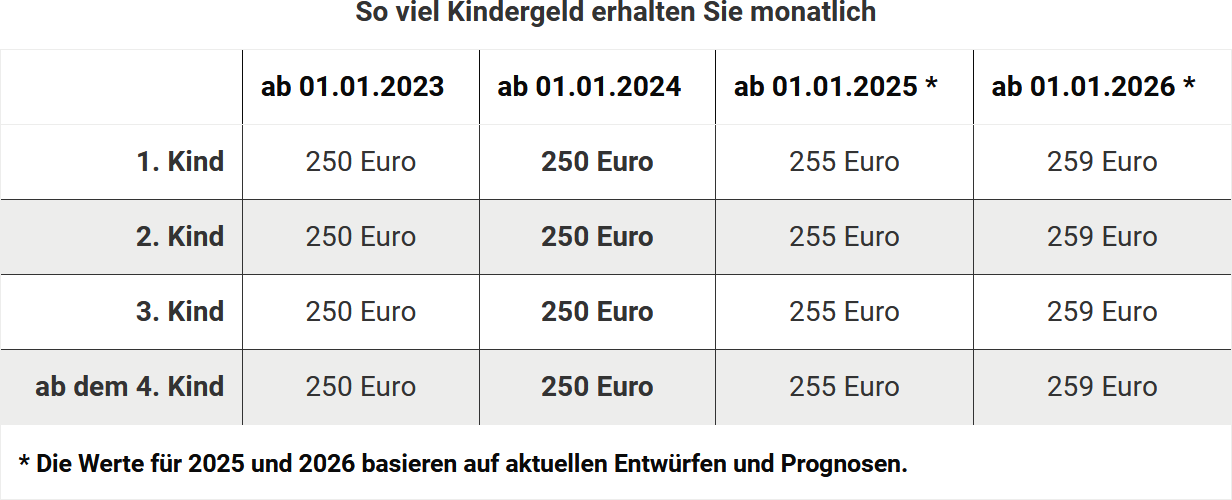

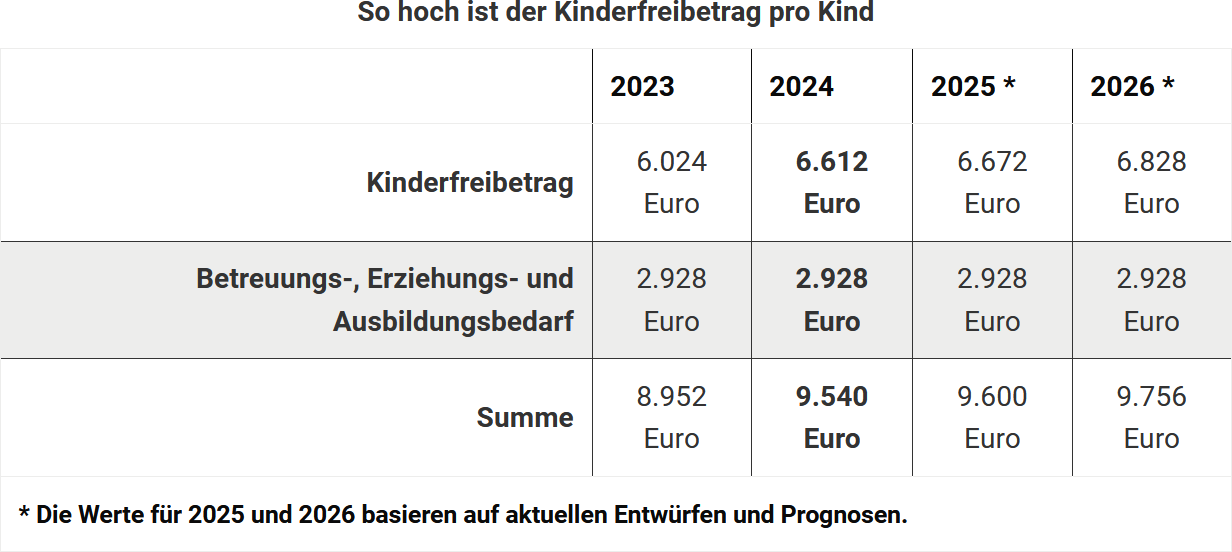

Child benefit and child allowance

Child benefit remains at 250 Euro per month per child. From 2025, child benefit will be increased to 255 Euro. The child allowance for 2024 has been increased to 6,612 Euro (3,306 Euro per parent). The child's tax identification number remains a prerequisite for child benefit and child allowance.

Training allowance

The training allowance has been 1,200 Euro since 2023. It is reduced if the child does not meet the requirements for the entire year or lives in a country with a lower standard of living.

Relief amount for single parents

The relief amount for single parents was increased to 4,260 Euro in 2023. The increase of 240 Euro for each additional child remains unchanged (§ 24b EStG).

Child benefit remains at 250 Euro per month per child. The child allowance for 2024 has been increased to 6,612 Euro (3,306 Euro per parent). The child's tax identification number remains a prerequisite for child benefit and child allowance.

New tax benefits for children living abroad

From 2024, tax benefits such as the child allowance, the BEA allowance (care, education, training) and the training allowance will no longer be reduced if the child lives in an EU or EEA country. A reduction will only apply to children in non-EU countries. Depending on the country, the allowance may be reduced by up to three quarters. This change is based on a ruling by the European Court of Justice (ECJ) to prevent discrimination in family benefits within the EU.

Minijob limit rises to 538 Euro

The Minijob limit increased to 538 Euro per month in 2024. In 2025, it will be raised to 556 Euro. These adjustments follow the increases in the minimum wage, which rose to 12.41 Euro per hour from 2024.

Employees

Flat rate for income-related expenses remains at 1,230 Euro

The employee allowance was increased from 1,200 Euro to 1,230 Euro on 1 January 2023 (§ 9a no. 1 EStG). If you do not claim individual income-related expenses, an amount of 1,230 Euro will also be applied in 2024. No proof is required.

Home office and study: New regulations from 2023

Since 2023, costs for a home office can be deducted if it is the professional centre, either in actual amount or at a flat rate of up to 1,260 Euro. If the home office is not used as a centre, a daily allowance of 6 Euro can be claimed for up to 210 days.

The allowances apply uniformly for the entire year and are offset against the employee allowance. Home office days must be documented.

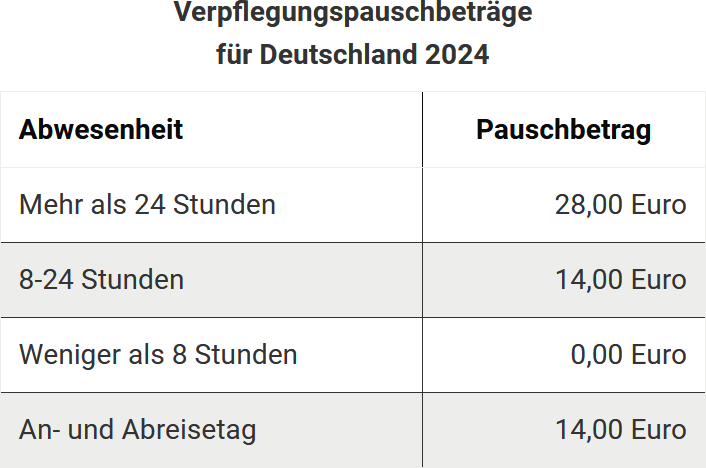

Meal allowances

The Federal Ministry of Finance has published new country-specific meal and overnight allowances for business trips abroad for 2024. Employees can deduct the meal allowances as income-related expenses or have them reimbursed tax-free by their employer. Overnight allowances may only be reimbursed tax-free by the employer, but actual overnight costs can be deducted if proven.

Allowances have been adjusted for countries such as Australia, Brazil, Canada, Italy, Spain and others. These apply from 2024 for business trips abroad and double housekeeping.

New overnight allowance for truck drivers

Since 1 January 2020, truck drivers who sleep in the cab of their lorry can claim an overnight allowance of 8 Euro per calendar day in addition to the meal allowance as income-related expenses. From 1 January 2024, this allowance has been increased to 9 Euro (§ 9 para. 1 sentence 3 no. 5b EStG). This still applies to expenses such as the use of showers, toilets or cleaning the sleeping cabin.

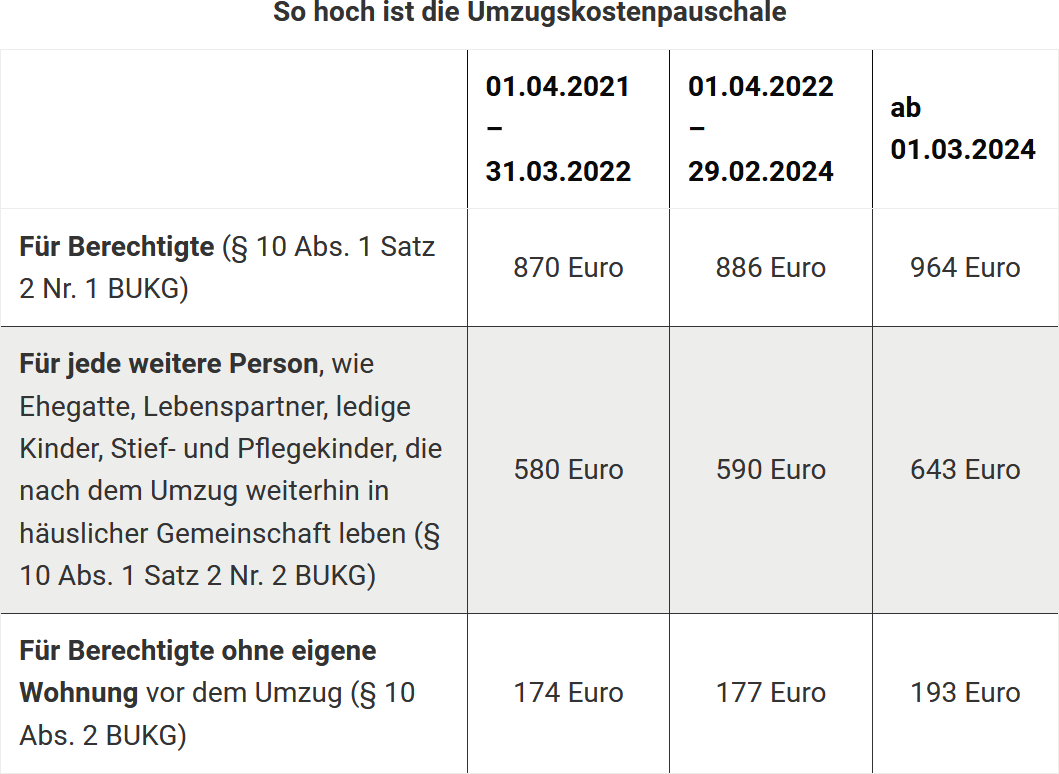

Relocation costs

If you move for work-related reasons, you can deduct relocation costs as income-related expenses or have them reimbursed tax-free by your employer. These include transport, travel and rental costs as well as estate agent fees. Other relocation expenses can be claimed as a lump sum. Since 1 June 2020, there has been a uniform allowance, regardless of family status, which will be increased again on 1 March 2024:

- For eligible persons: 964 Euro

- For each additional person (e.g. spouse, children): 643 Euro

- For unfurnished accommodation: 193 Euro

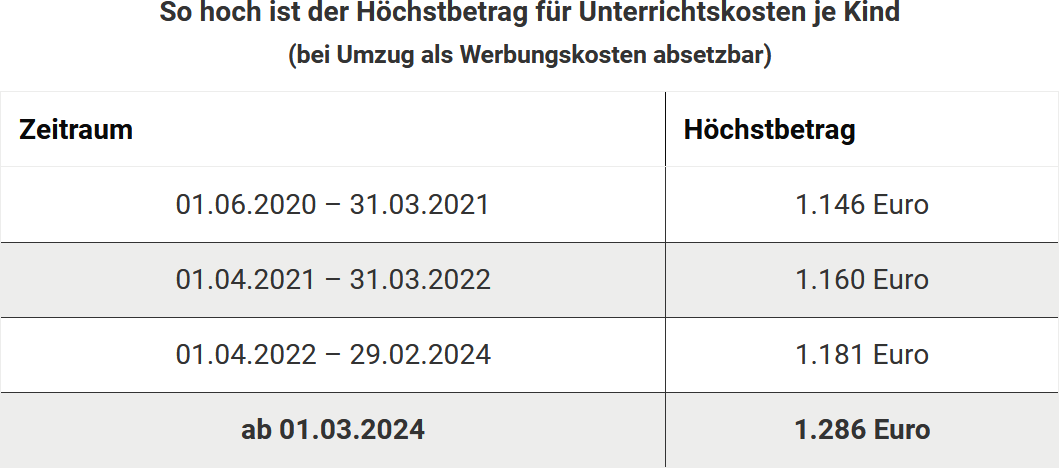

Tuition costs for children after a move can also be deducted up to 1,286 Euro.

Capital gains

Increase in saver’s allowance since 2023

The saver’s allowance was increased to 1,000 Euro for singles and 2,000 Euro for married couples in 2023. Exemption orders are automatically adjusted by the banks. If you have not yet issued an exemption order, you should do so to avoid unnecessary tax deductions. Deduction of actual income-related expenses remains excluded.

Advance flat rate for accumulating funds 2024

For accumulating funds that do not distribute earnings, investors must pay tax on an advance flat rate annually. This is not based on actual profits but amounts to 70% of the Bundesbank's base interest rate multiplied by the fund value at the beginning of the year. For 2024, the base interest rate is 2.29%, resulting in an advance flat rate of 1.603%. The advance flat rate is deemed to have accrued on 2 January 2025.

Changes for pensioners

Taxation of pensions

For pensioners who receive a pension for the first time in 2024, the taxable portion is 83%. An income-related expenses allowance of 102 Euro is deducted.

Taxation of pensions

Pension payments are still fully taxable. The pension allowance decreases annually, for retirees from 2024 it is 13.6%, maximum 1,020 Euro.

Constitutional complaint regarding double taxation of pensions rejected

The Federal Constitutional Court has rejected the constitutional complaints against the double taxation of pensions. The Federal Fiscal Court (BFH) ruled in 2021 that pension taxation is largely constitutional and that double taxation could only affect future pension cohorts. Affected persons must prove double taxation themselves. The tax authorities are expected to remove the provisional notes in tax assessments. Those affected should lodge an objection and submit the relevant calculations.

No deduction for study costs

Pensioners cannot deduct costs for a home office for their pension administration, as no active work is required for this. For freelance work, the cost deduction can be made if the home office is the centre of activity. Alternatively, a daily allowance of 6 Euro is possible. For pensioners, the home office is not deductible, as pensions are paid without active employment.

Support for dependants

Maximum maintenance amount

The maximum maintenance amount was increased to 11,784 Euro in 2024 and will be reduced if the maintenance recipient earns income over 624 Euro.

Harmless asset limit remains low

If you support dependants, you can claim the payments for tax purposes under certain conditions (§ 33a para. 1 EStG). An asset value of up to 15,500 Euro is considered harmless. Certain assets, such as owner-occupied houses or items whose sale would be tantamount to a giveaway, are considered exempt assets.

A recent ruling by the Federal Fiscal Court (BFH) has determined that the asset limit of 15,500 Euro still applies in 2019. In the case, the plaintiff won because maintenance payments are not immediately considered assets (BFH ruling of 29 February 2024, VI R 21/21). An advance maintenance payment of 500 Euro for January 2019 was not counted as the son's assets, as it was only received in 2019, reducing his assets to 15,450 Euro as of 1 January 2019.

Other tax changes

Health insurance: family insurance

Family members are co-insured free of charge if their monthly income does not exceed 505 Euro.

Tax relief for donations

Donations for Corona or Ukraine aid are deductible as special expenses up to 20% of income.

Tax relief after the 2024 floods

The Whitsun floods 2024 in the Saarland and other flood damage in Bavaria and Baden-Württemberg often lead to significant financial burdens. The state responds with tax relief, including tax deferrals, special depreciation for replacements and simplified proof for donations. Farmers and businesses also receive support through special disaster decrees. These measures help those affected to cope financially with the consequences of the disasters.

Medical expenses: Are dietary costs for coeliac disease deductible?

According to the BFH (decision of 4 November 2021, VI R 48/18), additional costs for a gluten-free diet for coeliac disease are not deductible as extraordinary expenses, as they replace usual food. A constitutional complaint has been filed against this decision (Ref. 2 BvR 1554/23).

Practical tip: The Federal Constitutional Court is also examining whether medical expenses must generally be reduced by the reasonable personal contribution (proceedings 2 BvR 1554/23 and 2 BvR 1579/22).

Business identification number: Allocation from November 2024

Since November 2024, the business identification number (W-IdNr.) has been issued by the Federal Central Tax Office (BZSt) and is to be completed by 2026. It is used to uniquely identify all businesses in Germany and to simplify official communication. The W-IdNr. is issued automatically, no application is required.

Note: The tax number and IdNr. will remain in place. Further information and FAQs at www.bzst.de.

Tax assessments: Extension of the notification presumption to four days

From 1 January 2025, the notification presumption period for tax assessments will be extended from three to four days (§ 122 para. 2 no. 1 AO). This applies to both postal and electronic notices to take into account longer postal delivery times due to the "Postal Law Modernisation Act".

Practical tip: If the fourth day falls on a weekend or public holiday, the notification is postponed to the next working day (§ 108 para. 3 AO).

Bewertungen des Textes: Tax return 2024: What's new

4.88

von 5

Anzahl an Bewertungen: 43