What is the advantage of capping the church tax?

If you belong to a religious community that collects taxes, you are obliged to pay church tax. The church tax is a supplementary levy on income tax and is generally based on your place of residence.

- 8 per cent of the assessed income tax in Bavaria and Baden-Württemberg

- 9 per cent in all other federal states

The basis for calculation is always the assessed income tax, not the taxable income. The higher the income tax, the higher the church tax.

Example (2024):

- Income tax: 52.397 Euro

- Church tax (9 per cent): 4.715 Euro

Capping of church tax for high incomes

For high incomes, the church tax can sometimes be disproportionately high. To limit this, the church tax laws of the federal states provide for the possibility of so-called capping. The reduced church tax resulting from this is referred to as the capping tax.

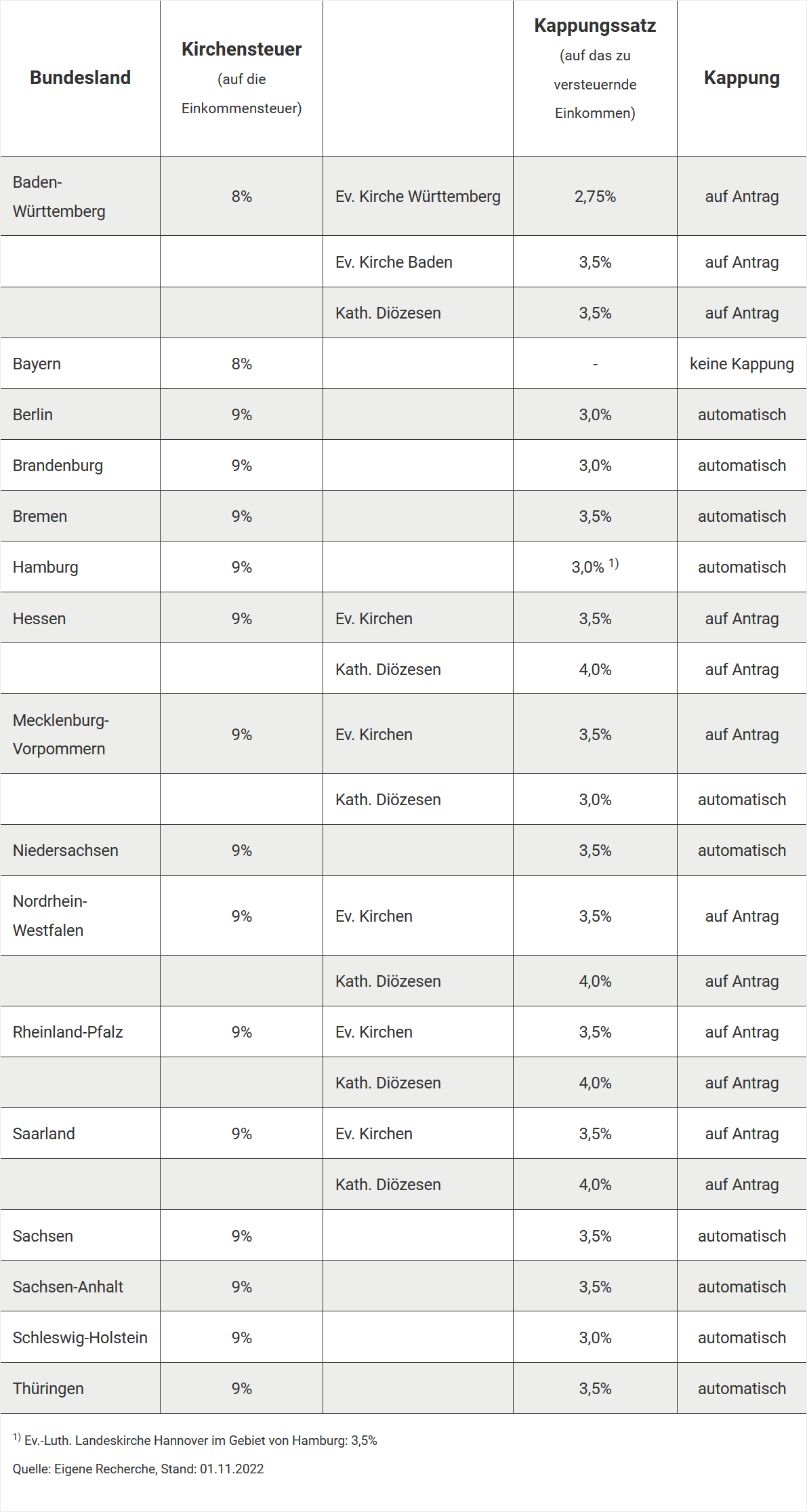

As part of the capping, the church tax is no longer calculated as a percentage of the income tax but is capped at a fixed percentage of the taxable income. This percentage – the so-called capping rate – varies depending on the federal state and ranges between 2.75 per cent and 4.00 per cent.

Example (Berlin, 2024):

- Taxable income: 150.000 Euro

- Income tax: 52.397 Euro

- Normal church tax (9 per cent): 4.715 Euro

- Capping rate Berlin: 3 per cent

- Capping tax (limit): 4.500 Euro

Result: In this case, the capping results in a saving of 215 Euro on the church tax.

Automatic or requested capping?

Whether church tax capping occurs automatically or requires a separate application depends on the federal state. In some states, the capping tax is automatically taken into account in the tax calculation. In others, an application to the relevant church is necessary.

Application for church tax capping

In federal states without automatic capping, you must submit an informal application for capping tax. The application should be addressed to your relevant diocese (for Catholic denomination) or regional church (for Protestant denomination).

You should enclose a copy of your latest income tax assessment with the application. This is the only way to check whether capping can be granted and how high the maximum church tax (i.e. the capping tax) may be.

Note: The capping is not processed through the tax office but directly through the church.

Conclusion: The capping tax can lead to significant relief for high incomes. Check whether your federal state provides for automatic capping or whether you need to take action yourself.