What is the relocation allowance?

For a work-related move, you can deduct the moving expenses as income-related expenses or have them reimbursed tax-free by your employer. Moving expenses include transport costs, travel expenses, double rent payments, estate agent fees for a rental property, and other moving expenses.

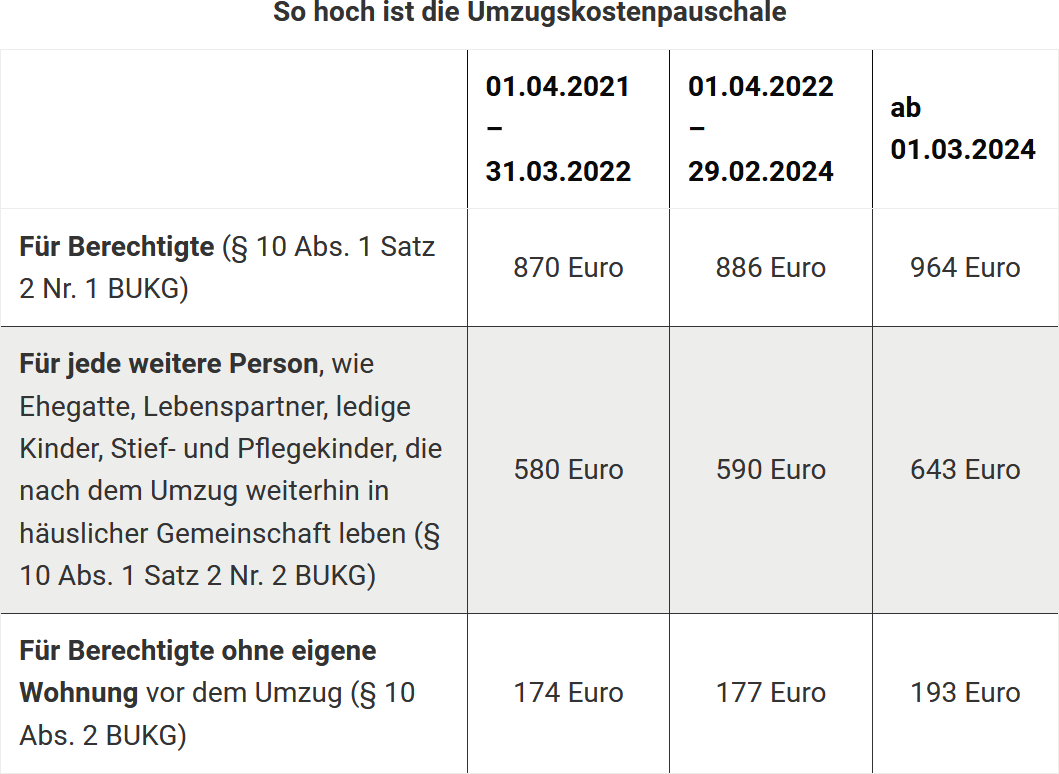

While the aforementioned costs can be deducted in the amount proven, other moving expenses can be claimed with a lump sum for other moving expenses.

The Federal Ministry of Finance has recently increased the moving expense allowances for work-related moves from 1 April 2022 (BMF letter dated 21.7.2021, IV C 5 - S 2353/20/10004).

There is one detail you should be aware of: For moves, the day before the loading of the removal goods is decisive for calculating the allowances.

The moving allowance covers:

- Tips for removal men and other helpers. This also includes, for example, inviting friends to a meal as a thank you for their help with the move.

- Professional assembly and disassembly of lamps, fitted kitchens, and other electrical appliances.

- Professional installation and alteration of curtains, blinds, and their fittings.

- Re-registration fees.

- Advertisements for house hunting.

- Costs for cosmetic repairs in the old flat, provided you are contractually obliged to cover them (but not cosmetic repairs in the new flat, as these are privately incurred).

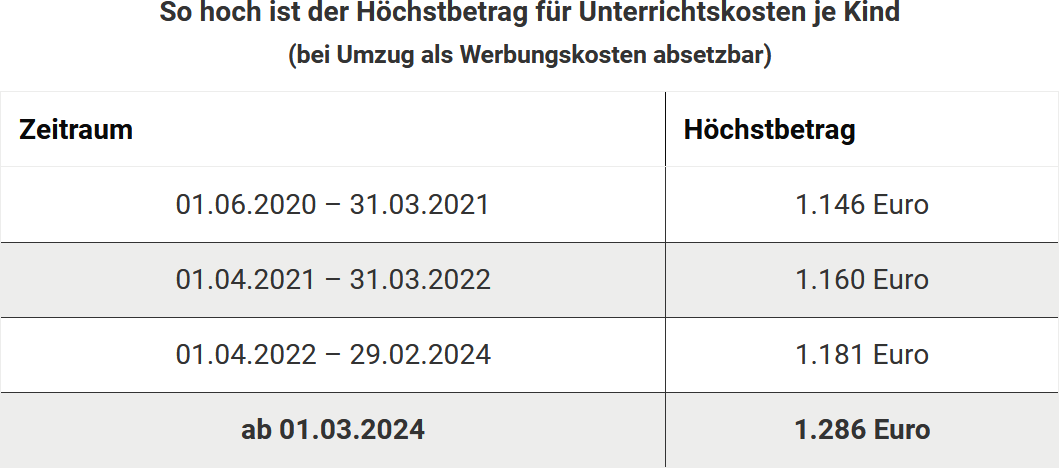

If children require tutoring after a work-related move, the costs can be deducted as income-related expenses up to a maximum amount. This maximum amount will also be increased.