How do I submit my tax return?

You transfer your data securely and electronically encrypted via online submission with identification directly to the tax office – either with your personal certificate or with the portal certificate from SteuerGo.

Alternatively, you have the option of paper submission with electronic data transfer and subsequent signature. You send the signed printout of the tax return along with the supporting documents by post to your tax office.

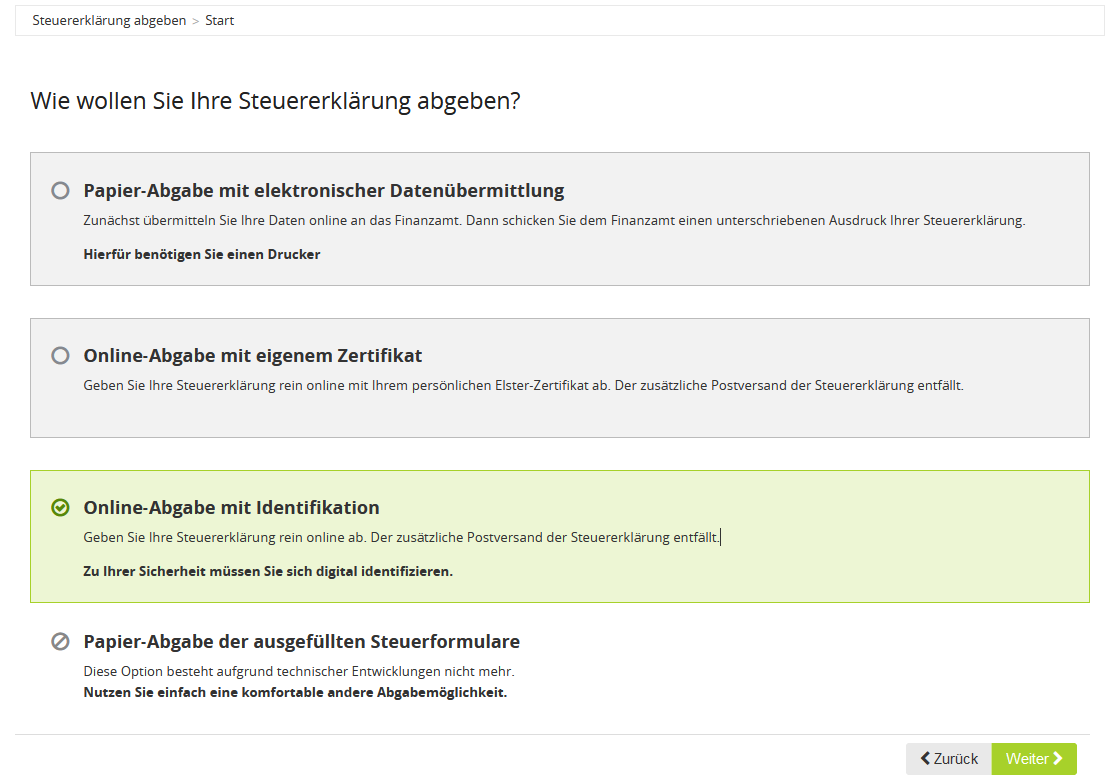

Your possible submission methods at a glance:

- Online submission with personal certificate

Submit your tax return entirely online with your personal Elster certificate. There is no need to send the tax return by post.

- Online submission with identification

Submit your tax return entirely online. There is no need to send the tax return by post.

- Paper submission with electronic data transfer

First, transfer your data online to the tax office. Then send the tax office a signed printout of your tax return.

Important note: The tax authorities no longer allow paper submissions from the 2021 tax year. Simply use another convenient submission method. For declarations for previous tax years, "paper submission with electronic data transfer" can still be used.

There are no price differences, so you can freely choose the desired submission method. Regardless of the submission method, SteuerGo will of course inform you which legally required supporting documents must be submitted to the tax office by post.

For your tax return to be legally valid, you must provide a signature in the case of paper submission, i.e. even with paper submission with electronic data transfer, the compressed tax return must be printed out, signed on the first page, and then sent to the tax office.

Bewertungen des Textes: Wie gebe ich meine Steuererklärung ab?

3.65

von 5

Anzahl an Bewertungen: 355