SteuerGo bietet als besonderen Service den Datenabruf an. Dadurch haben Sie die Möglichkeit, personenbezogene Daten abzurufen, die beim Finanzamt über Sie gespeichert sind. Diese Daten können Sie direkt in Ihre Steuererklärung importieren.

Nachdem Sie den Service einmalig eingerichtet haben, erhalten Sie sofort Einblick in die Daten, die beim Finanzamt über Sie vorliegen.

Bitte beachten Sie, dass nur die Daten der letzten 4 Steuerjahre abgefragt werden können. Das bedeutet, dass im Jahr 2026 nur die Daten von 2025, 2024, 2023 und 2022 abgerufen werden können.

What is data retrieval?

Data retrieval is a service offered by SteuerGo. Through data retrieval, you can access personal data stored about you at your tax office and import it directly into your tax return.

Note: Data can only be requested for the last 4 tax years, i.e. in the year 2026 you can retrieve data for 2025, 2024, 2023 and 2022.

Once data retrieval has been activated, the tax authorities usually provide your data within 48 hours. We will inform you by email as soon as the data is available. You can then import all data into your tax case via the "My tax return" page. If your tax office provides new data for you, we will automatically notify you in the future.

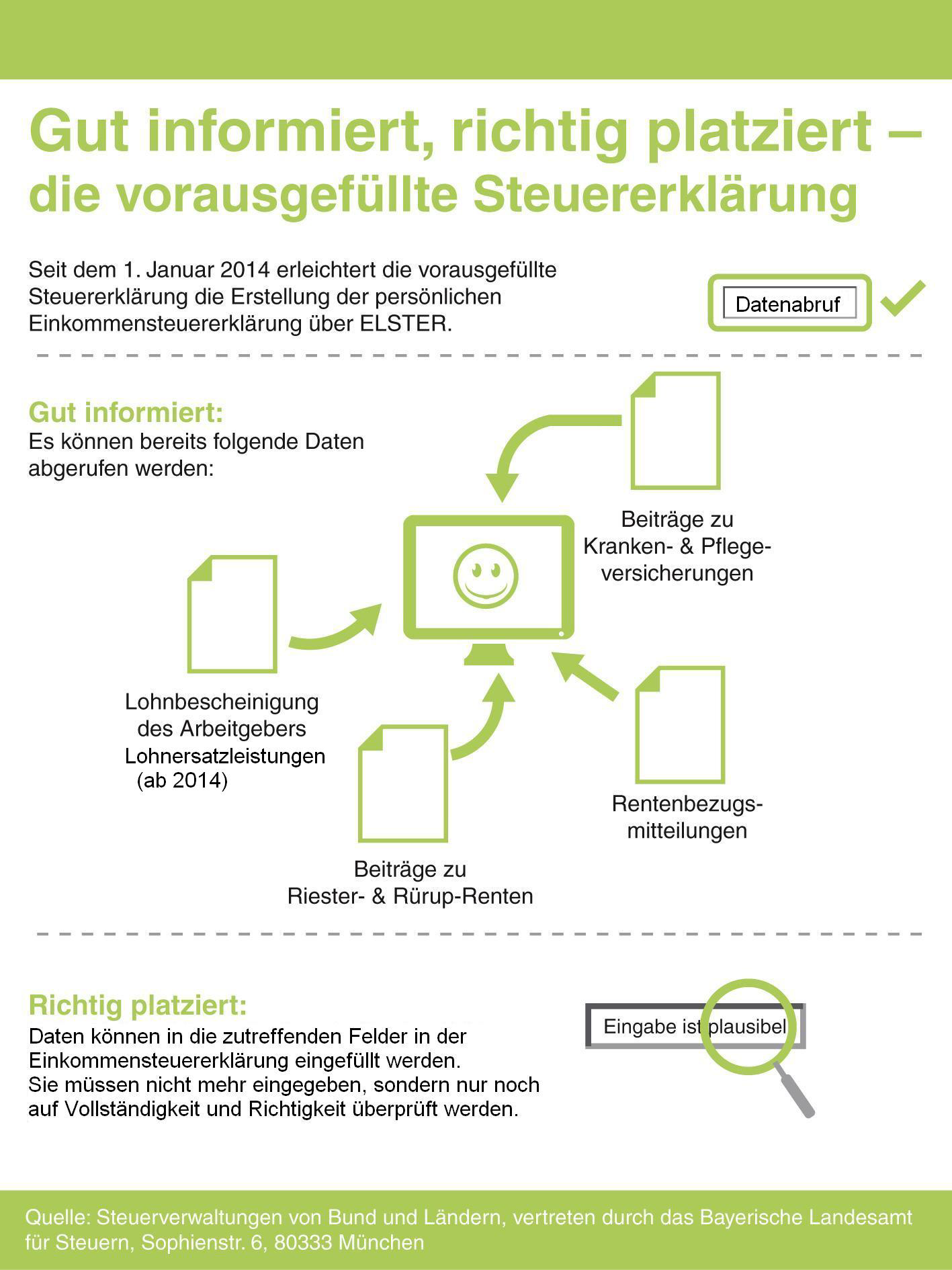

The following stored data about you is provided by the tax authorities as part of the so-called "pre-filled tax return" (VaSt):

- Master data of the tax account holder, including name, address, date of birth, tax identification number and bank details

- Information on religious affiliation

- Wage tax statements submitted by the employer

- Pension receipt notifications for benefits from statutory pension insurance, private pension insurance or retirement contracts

- Insurance contribution certificates - particularly for paid and refunded contributions to health and long-term care insurance

- Retirement provision expenses

- Contributions to basic provision (Rürup pension)

- Contributions to Riester pension

- Certificates for wage replacement benefits such as unemployment, parental or sickness benefit

The data scope is to be gradually expanded in the coming years. It is planned to collect further electronic data in the future and make it available to taxpayers for data retrieval. This includes, among others:

- Capital-forming benefits

- Parts of Annex V (e.g. standard value file reference, location of the property)

- Donation receipts

- Degree of disability

The legal basis for this was created in 2016 with the Act to Modernise Taxation Procedures.

With data retrieval, the information mentioned can be displayed and also automatically transferred to your income tax return. Even if you retrieve and transfer electronic data, all entries can still be manually changed and corrected if necessary.

Important: If you make changes because you believe the tax office has incorrect or outdated data, you should also provide proof of the change to the tax authorities. Otherwise, the changes you made are very likely to be deleted to your disadvantage.

Online submission of your tax return

Once you have activated data retrieval in SteuerGo, the tax return can be submitted immediately. For this purpose, the master data of the tax account holder (including name, address, date of birth, tax identification number) stored by the tax authorities is checked against the information in the tax return for identification.

What is data retrieval?

What are the benefits of data retrieval with SteuerGo?

- Fewer errors in data entry:

Manual entry of certificates is no longer necessary. You only need to review and, if necessary, supplement the data after importing.

- Incorrect entries are prevented:

The data is entered into the correct fields in the income tax return.

- You save time:

You only need to check the imported data. This gives you more time for additions that can really save tax, such as expenses for craftsmen's services, work-related expenses, or special expenses.

- Greater transparency:

You already know which data the tax office has about you when preparing the tax return. This increases transparency in the otherwise rather opaque taxation process.

- Deviations at a glance:

With the optional retrieval of assessment data, you can see any deviations at a glance, making it easier to check the tax assessment.

- Online submission

Once you have activated data retrieval, the tax return can be submitted online immediately.

What are the benefits of data retrieval with SteuerGo?

How does data retrieval simplify the completion and submission of the tax return?

- The electronically provided data can be automatically transferred into your income tax return.

- When you open your tax return on the SteuerGo website, you can retrieve the data directly on the "My tax return" page and import it into your tax return.

- As soon as the tax authorities provide new data or an updated version of existing data, you will automatically receive a notification by email.

Note: Data can only be requested for the last 4 tax years, i.e. in the year 2026 you can retrieve data for 2025, 2024, 2023 and 2022.

Online submission of your tax return

Once you have activated data retrieval in SteuerGo, the tax return can be submitted immediately. For this purpose, the master data of the tax account holder (e.g. name, address, date of birth, tax identification number) stored by the tax authorities will be checked against the information in the tax return for identification purposes.

How does data retrieval simplify the completion and submission of the tax return?

From when can I use the offer for electronic data retrieval?

The tax authorities provide the latest electronic data at the beginning of the following year. So, if you want to process the tax return for 2025, the electronic data will be available for retrieval at the earliest at the beginning of 2026.

However, the data relating to you personally can only be displayed once it has been submitted to the tax authorities. For example, your employer or your health insurance company has until 28 February of the following year to submit the data for your income tax return, in accordance with legal deadlines.

Employers must therefore report the electronic data for the payslip for the year 2025 to the tax authorities by the end of February 2026 at the latest. It is therefore advisable to use the data retrieval from March of the following year.

If you have set up electronic data retrieval with SteuerGo, you will automatically receive an email notification as soon as new data is made available for you by the tax authorities.

From when can I use the offer for electronic data retrieval?

Is the data retrieval secure?

Data protection is of the utmost priority for SteuerGo. Only you can access and view your data in your customer account.

You transfer your data over the Internet. To protect tax confidentiality, tax data is always encrypted.

- The software and data are hosted in a high-security data centre in Germany.

- All tax data is stored in encrypted form.

- Secure HTTPS transfer of your data (SSL certificate).

- Strong 256-bit encryption, root certificate with 2048 bits.

For more information, please refer to our privacy policy.

Is the data retrieval secure?