How can I amend data that has already been submitted?

If you have already submitted your tax return electronically to the tax office but need to make some changes, that's no problem. Simply resend the data to the tax office via ELSTER.

Due to the individual Telenumber, the new data is firmly linked to the newly created compressed tax return. This means that the processor at the tax office can only process the data you have sent that matches the tax return you submitted. The previously sent data - however many there were - is automatically deleted.

Important

Always submit the compressed tax return to your tax office that corresponds to the data last sent via ELSTER. Only then is it ensured that the clerk can retrieve the data for your tax case from the tax office's servers.

How can I amend data that has already been submitted?

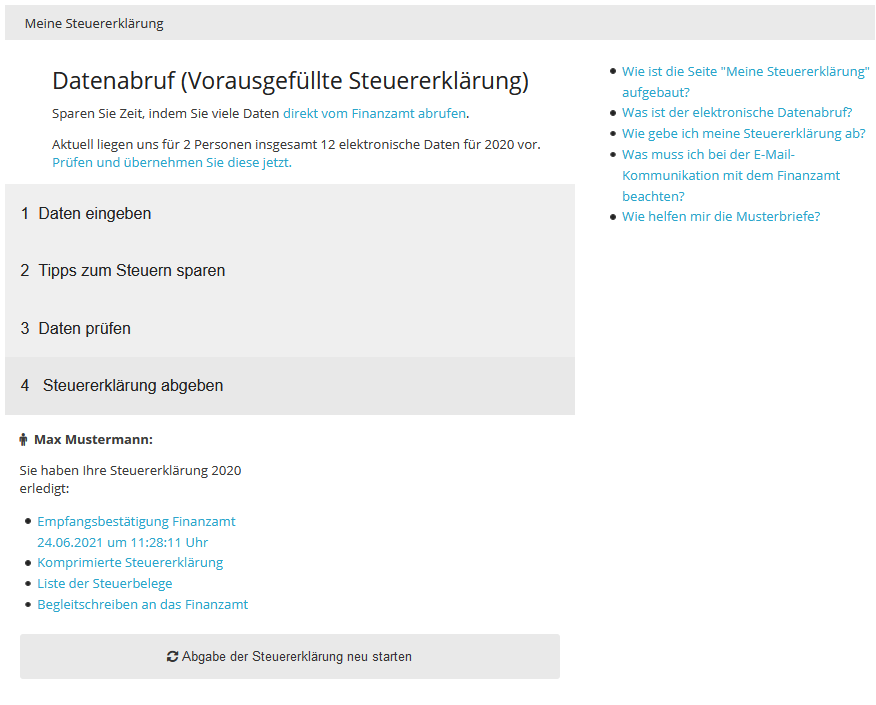

Will I receive confirmation of receipt for submitting my tax return?

After you have electronically submitted your tax return to your tax office using SteuerGo, you will receive an acknowledgement of receipt, which includes the following information:

- Transfer ticket

- Tele number

- Submission date

The acknowledgement of receipt is also available in your personal area on SteuerGo along with the compressed tax return as a PDF file after electronic submission.

With the transfer ticket and tele number, the tax office confirms the electronic receipt of your tax data.

Important

If you choose paper submission with electronic data transfer, the tax return will only be processed at the tax office once you have printed, signed, and submitted the tax return by post.

Will I receive confirmation of receipt for submitting my tax return?

What data is stored by SteuerGo?

After electronic transmission, SteuerGo saves the confirmation of data receipt (transmission report) for you as well as the compressed tax return, which is generated after transmission to the tax authorities as proof of the correct electronic transmission of your data.

Both documents are stored in encrypted form for data protection reasons, but can be viewed at any time in the personal data section.

What data is stored by SteuerGo?

How long may it take the tax office to process the tax return?

Unfortunately, there is no deadline by which the tax office must process your tax return! Based on experience, as a rule, it can take between 2 and 3 months to process your tax return.

In case of doubt, it may be advisable to call the person responsible for processing your tax return.

Important: The tax office cannot take as long as it wants to process your tax return. If more than six months have passed since you submitted your tax return without the tax office taking action, you have an option to file a so-called objection of failure to act. You can file this objection with your tax office (sect. 347 para. 1 sentence 2 of the Fiscal Code (AO)).

How long may it take the tax office to process the tax return?

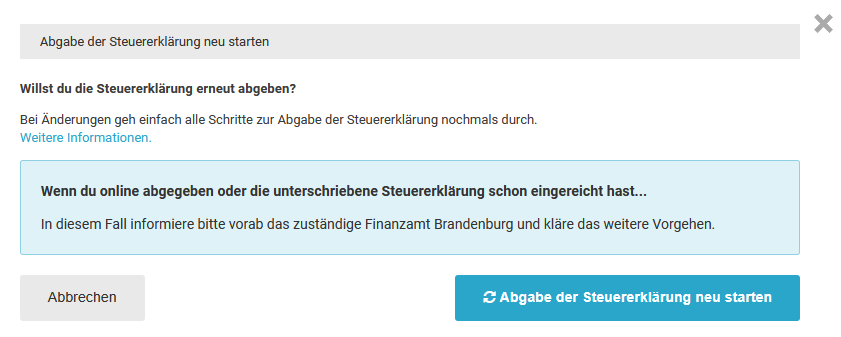

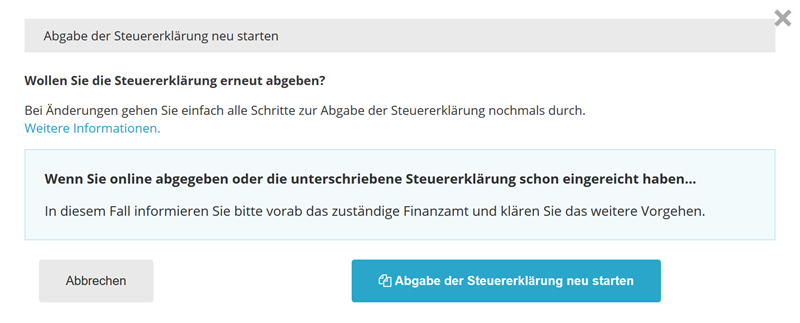

Do you want to resubmit your income tax return?

If you have discovered an error in your tax return, you can correct it even after submission. How you proceed depends on whether and how your return has already been submitted to the tax office.

Case 1: Tax return not yet submitted to the tax office

No problem – you can adjust your data in SteuerGo at any time and resubmit the tax return electronically.

The tax office automatically processes the most recently submitted version of your return. No separate notification to the tax office is required.

Case 2: Tax return already submitted electronically (certified or with identification)

In this case, you can also resubmit your tax return to the tax office.

Tip: Inform your local tax office by phone in advance that you are sending a corrected return. This will prevent your original tax case from being processed or the notice being issued.

Case 3: Tax assessment notice already received

If you have already received a tax assessment notice, resubmission is no longer sufficient. In this case, you must formally appeal against the notice to allow for a correction.

You can find a corresponding template in our sample letters under the title: “Appeal due to error”.

Questions or support?

Our customer service will be happy to assist you: hilfe@steuergo.de

We will also be happy to call you back if you wish.

Do you want to resubmit your income tax return?