What is the purpose of the navigation tree?

In the navigation tree, all topics and pages of your current tax interview are displayed in a thematically sorted structure. This tree provides you with an overview of the scope of your tax return and the ability to conveniently access specific pages for entries or changes.

What is the purpose of the navigation tree?

How is the tax calculated?

A significant advantage of using SteuerGo instead of forms is the calculation and optimisation of refunds or additional tax payments. The tax calculation provides an overview of the expected tax assessment based on your data at any time.

In addition, SteuerGo offers further significant advantages compared to the usual presentation of the tax assessment:

- You can view calculation details by clicking on the amount of the expected tax liability. All coloured items can be clicked for further details.

- Clicking on total values takes you to detailed calculation sheets with interim results.

- By clicking on the name of an item, you are taken to the underlying input page.

- SteuerGo always shows the calculation for joint and separate assessment for spouses. This also serves as the basis for the final choice of assessment type.

- Based on your entries, SteuerGo provides valuable tips for tax optimisation and possible input errors.

Note: The final determination of the tax liability and any resulting tax refund or additional payment is made exclusively by the relevant tax office and may differ from the SteuerGo calculation.

How is the tax calculated?

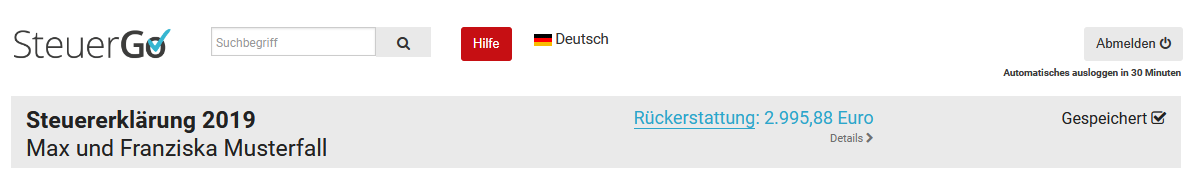

Is it possible to view the current status of the refund?

While entering your tax data, you can view the current status of your tax calculation at any time in the upper area.

This allows you to check how your income and expenses directly affect your tax refund.

Is it possible to view the current status of the refund?

Can the SteuerGo calculation differ from the tax assessment notice?

It is often overlooked that tax assessments are not fully automated but are prepared by clerks. Their intervention often makes a tax assessment difficult to understand.

If the tax assessment differs from the calculation by SteuerGo, this is often due to the following reasons:

- The tax office makes corrections if your details differ from official data, e.g. from the employer's payroll tax report.

- Certain expenses claimed in the tax return are not recognised and are removed by the tax office. This must be indicated in your tax assessment. SteuerGo already helps you in the interview and in the guide to avoid this by making legally compliant entries.

- The maximum amounts for some expenses are subject to very complex calculation rules, where the tax office can use unofficially known parameters (e.g. personal circumstances).

Can the SteuerGo calculation differ from the tax assessment notice?