What is data retrieval and why do I need it?

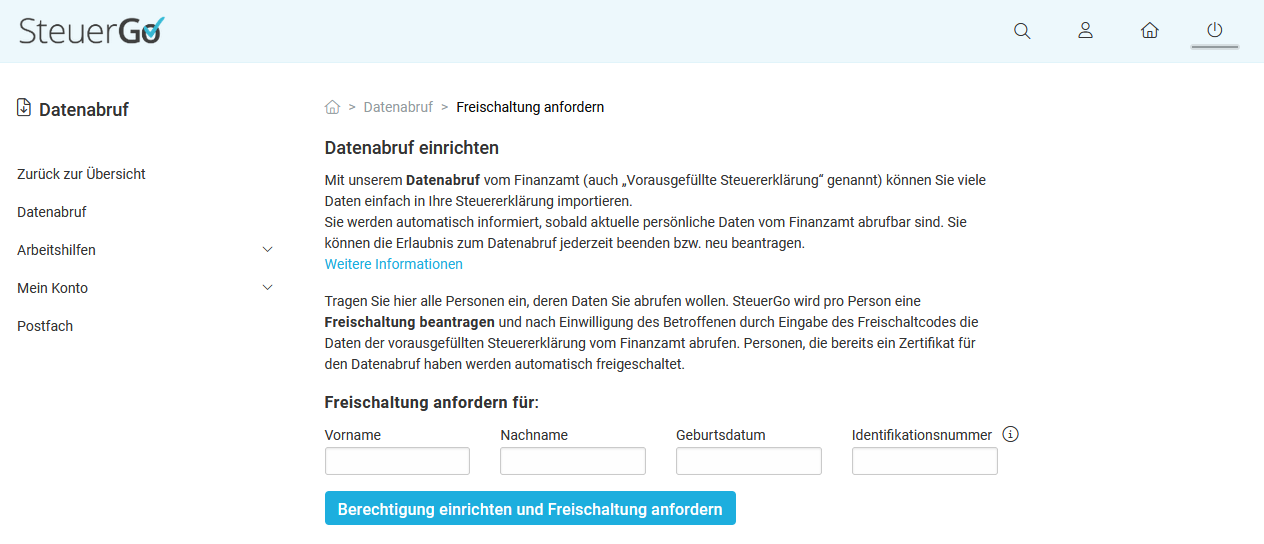

Data retrieval is a service offered by SteuerGo. Through data retrieval, you can access personal data stored about you at your tax office and import it directly into your tax return. The tax authorities also refer to the data provided as the "pre-filled tax return" (VaSt). (More information at: What is electronic data retrieval?)

Once you have set up the service, you will immediately know what data the tax office has about you. Note: Data can only be retrieved for the last 4 tax years, i.e. in the year 2025 you can retrieve data for 2024, 2023, 2022 and 2021.

If you have activated data retrieval in SteuerGo, you can immediately use the online submission for your tax return. The master data of the tax account holder (e.g. name, address, date of birth, tax identification number) stored by the tax authorities is checked against the information in the tax return for identification purposes. Activation of data retrieval with the tax authorities is a one-time process and takes up to 2 weeks.

You can then transfer the provided data to your income tax return at SteuerGo with just a few clicks. This means you do not have to enter the data yourself. Your data is transferred directly into the corresponding fields of the income tax return, thus largely avoiding input errors. You only need to check the transferred data for accuracy.

This gives you more time for additions that can really save taxes, such as expenses for craftsmen's services, work-related expenses or special expenses.