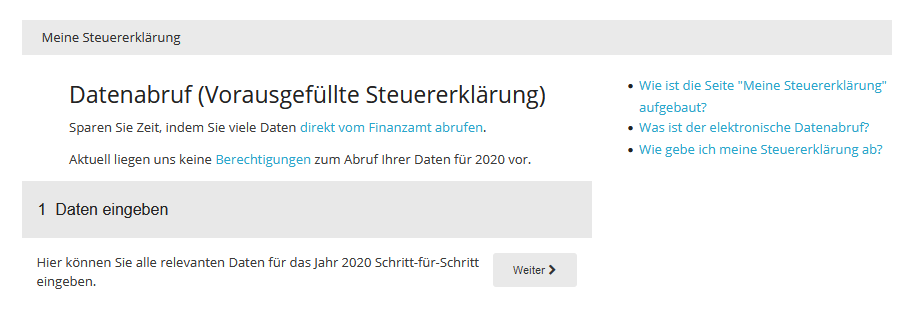

How is the "My Tax Return" page structured?

1 Enter your data

In the section "Enter data" of SteuerGo, the tax interview will be used to collect your data for the tax return. The interview asks the relevant questions by topic and guides you step-by-step through the relevant pages of your tax return.

Do you use electronic data retrieval? Here you can retrieve your electronic data directly from your tax office.

Note: The electronic data retrieval is available from the tax year 2014!

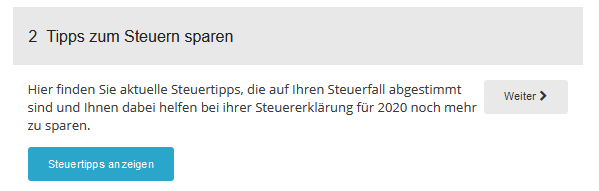

2 Tips for saving taxes

In this section, you will find current tax tips that are tailored to your tax case and will help you to save even more on your tax return.

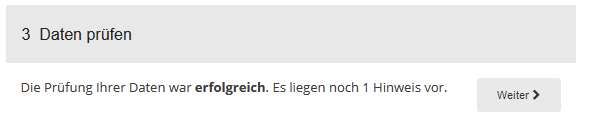

3 Check data

During the data check, the data you entered in the tax return is checked for reliability, for example, whether your personal details are completely entered.

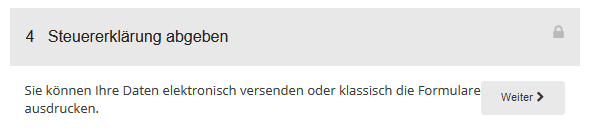

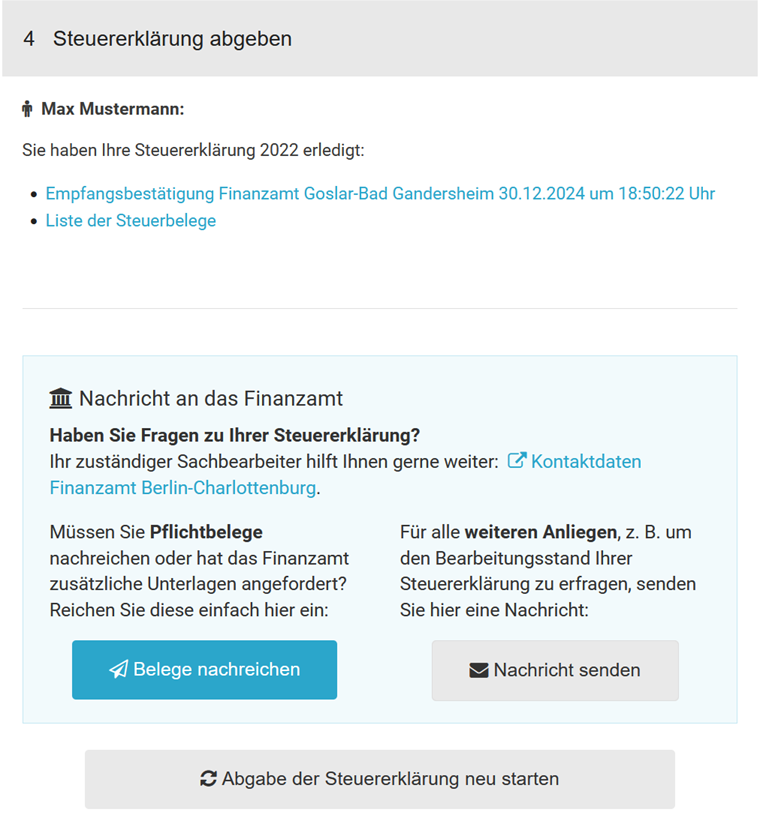

4 Submit your tax return

If you want to submit your tax return, you will find the link to the "Submission" page here.

Note: For the transmission of your tax return to the relevant tax office, you first have to pay and thus activate your tax return.

After you have submitted your tax return electronically, here you will find the confirmation of receipt (Empfangsbestätigung) from the tax office (with telenumber (Telenummer) and transfer ticket (Transferticket)) along with all important documents related to your tax return that you can download.

Send documents to the tax office

In all federal states, you have the option to submit additional documents to the tax authorities electronically. However, you should not submit any receipts without being requested to do so. The tax authorities explicitly state that you should only submit receipts after being requested to do so by the tax office.

For more information, see the section "Send documents to the tax office".

Restarting the tax return submission process

If you find an error after submitting the tax return, here you can reset an already completed submission and start the submission process again.

If you make any changes, simply go through all the steps for submitting your tax return again. The tax office does not start processing until the signed tax return has been received. If you have already completed the submission, you can reset the submission process by clicking on the button "Restart submission of the tax return" and go through the submission process again.

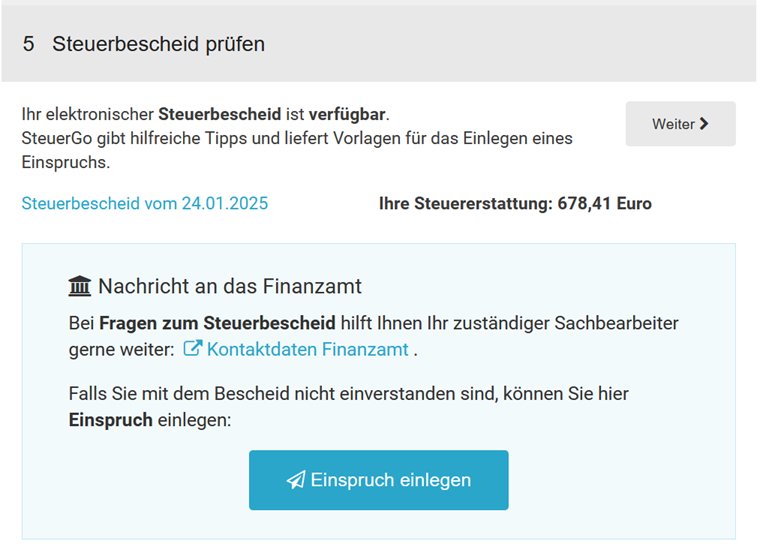

5 Check tax assessment notice

Here you can check your electronic tax assessment notice and file direct objections in case of any deviations.

As soon as the tax authorities provide the electronic tax assessment for collection via ELSTER, you will receive an automatic e-mail notification from SteuerGo. SteuerGo gives helpful tips and provides templates for filing an objection.

Note: The review of the tax assessment notice will be available from 2012 and must be activated for a fee.

Information about your tax office

Here you will find the current postal address and contact details (telephone, fax, e-mail) of your relevant tax office, which you have previously specified in the entry field. The address of the tax office is automatically added to the address field when the generating sample letters are requested.

On the basis of our client's tax returns, we can also give you a statement about the average processing time of a tax return at your tax office!

If you have any questions about the processing status, you have the relevant contact data directly available. Here you also have the possibility to rate your tax office.

Sample letters

In this area, you will find sample letters and applications on various tax issues. The templates contain suitable standard text and placeholders for the required data so that you can easily create an individual document.

Online tax calculators

Unfortunately, it is not easy to keep an overview of the necessary information in the tax world. Every year, various changes are decided upon: Newly introduced regulations, such as changed deductions, can lead to uncertainty and disorientation among those affected. Our free tax calculators give you quick answers to your questions.

The online tax calculator from SteuerGo gives you a quick overview of the expected tax burden, your actual net salary or the state subsidy for your private pension plan.

Bewertungen des Textes: Wie ist die Seite "Meine Steuererklärung" aufgebaut?

3.75

von 5

Anzahl an Bewertungen: 28