(2023)

How is the statutory pension taxed?

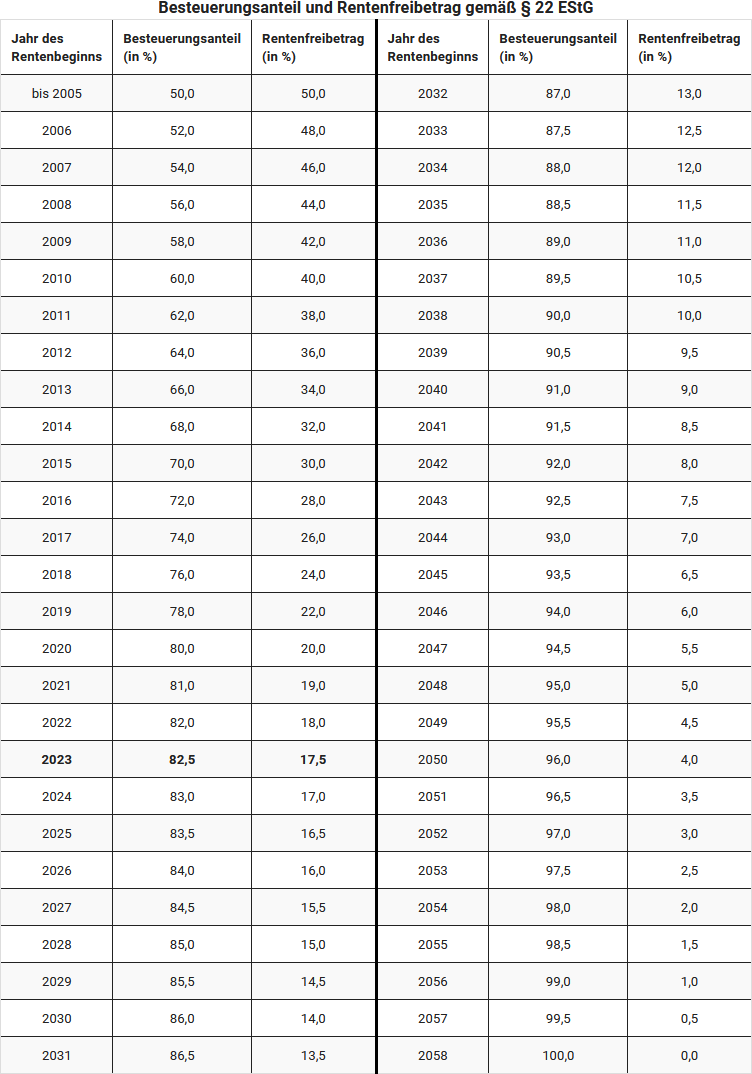

In 2005, the legislator reformed the taxation of state pensions through the Retirement Income Act. Since then, a fixed portion of the pension is taxable, while the rest remains (for now) tax-free. You must declare your pension income, which is known as deferred taxation. The amount to be taxed depends on the year you started receiving your pension.

For individuals who retired in 2005 or earlier, the tax-free portion was 50 percent. A (personal) allowance is created from the non-taxable pension, allowing these pensioners to use a "pension allowance" of 50 percent from 2005 onwards. This pension allowance remains unchanged for life.

Since 2005, the so-called taxable portion has increased annually by two percentage points, and from 2021 by one percentage point per year. Originally, individuals retiring from 2040 onwards were to fully tax their state pension income. However, due to amended legislation, the taxable portion will increase by only half a percentage point annually from 2023, starting with the 2023 pensioner cohort, and will reach 100 percent for the 2058 cohort for the first time (§ 22 No. 1 letter a double letter aa EStG, amended by the "Growth Opportunities Act").

For pensioners who start receiving their pension in 2023, the taxable portion is 82.5% of the pension amount.

The tax office automatically deducts an allowance for advertising costs of 102 Euro without further proof. If you have higher expenses, you should declare them in your tax return to reduce your taxable income. You can declare, for example, tax consultancy costs (for form R), pension advice, or a lawyer if they support you with pension matters. However, you must prove the higher expenses in any case.

Hans Müller retired on 1 January 2009 and received a state pension of 12.000 Euro last year. For Hans Müller, 58 percent of his pension is taxable, and the pension allowance is 42 percent. Thus, Müller would have to declare 6.960 Euro as income to the tax office for the year. However, if he has no other income, he does not have to submit a tax return, as the amount is below the basic allowance of 10.908 Euro (2023).

The lifelong pension allowance for Hans Müller is 5.040 Euro. However, he would only have to tax income above this allowance if it also exceeds the basic allowance.

Income from renting and leasing or capital gains must, however, be added to the income.

If Hans Müller were to receive a pension of 15.000 Euro and retire in 2023, he would have to tax 12.375 Euro (82.5 percent) of his pension and therefore also submit a tax return.

Note: The pension allowance for Müller remains the same for life. Even if his pension income increases due to pension adjustments, only 5.040 Euro would remain tax-free each year in the first example. The allowance refers to a specific amount of money, not a percentage of the respective pension. Thus, Mr Müller must fully tax future pension adjustments.

Bewertungen des Textes: Wie wird die gesetzliche Rente besteuert?

5.00

von 5

Anzahl an Bewertungen: 5