(2023)

New overnight allowance for professional drivers

In 2020, a new overnight allowance was introduced. Until now, long-distance lorry drivers who sleep in their truck cabins have not been able to claim overnight allowances. However, they incur expenses for using sanitary facilities at service stations (showers, toilets) and for cleaning the truck cabin (bedding).

Such expenses can already be deducted by long-distance lorry drivers as incidental travel expenses in an estimated amount for tax purposes or reimbursed tax-free by the employer (BMF letter dated 4.12.2012, BStBl. 2012 I p. 1249; BFH ruling dated 28.3.2012, VI R 48/11).

From 1.1.2020, a new travel allowance for long-distance lorry drivers was introduced, which can be claimed instead of the actual costs. The overnight allowance of 8 Euro per calendar day can be claimed as business expenses in addition to the "normal" meal allowance. The new overnight allowance applies to

- the day of arrival or departure, and

- each calendar day with an absence of 24 hours during an external activity in Germany or abroad (§ 9 para. 1 sentence 3 no. 5b EStG, inserted by the "Act on Further Tax Promotion of Electromobility and Amendment of Other Tax Regulations"). The overnight allowance of 8 Euro is taken into account for each calendar day on which the employee could claim a meal allowance for external activity.

- This allowance is applied instead of the actual additional expenses. If the new allowance is claimed, the amount of the actual expenses is irrelevant. Only actual expenses must have been incurred in principle.

- Higher expenses than the 8 Euro can also be proven and claimed (e.g. based on the BMF letter dated 4.12.2012, BStBl. 2012 I p. 1249). The decision to claim the actual additional expenses or the statutory allowance can only be made uniformly in the calendar year.

- Additional expenses are usually expenses that are included in the overnight costs deductible as business expenses for other employees with overnight stays during a business trip. Expenses may therefore include:

- Fees for using sanitary facilities (toilets, shower or washing facilities) at service stations and truck stops,

- Parking or storage fees at service stations and truck stops,

- Expenses for cleaning the truck cabin.

- The employer can provide reimbursements uniformly in the calendar year either up to the amount of the proven actual additional expenses or up to the amount of the new allowance tax-free.

- The new overnight allowance applies not only to employees but also to self-employed long-distance lorry drivers (§ 4 para. 10 EStG).

Tip: If you want to claim an amount higher than the overnight allowance, the following procedure is recommended: Record all expenses for a representative period of 3 months. You can then determine the daily cost amount from this and use it as a basis in the future, as long as the circumstances do not change significantly. The expenses do not include vouchers that you use to offset purchases (BMF letter dated 4.12.2012).

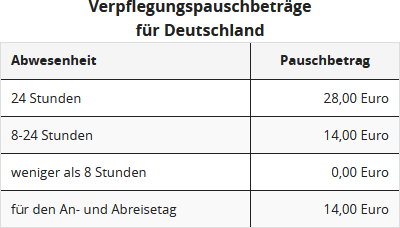

Current meal allowances will be increased from 1.1.2020, by 4 Euro or 2 Euro in Germany (§ 9 para. 4a sentence 3 EStG, amended by the "Act on Further Tax Promotion of Electromobility and Amendment of Other Tax Regulations").

Bewertungen des Textes: Neuer Übernachtungspauschbetrag für Berufskraftfahrer

5.00

von 5

Anzahl an Bewertungen: 1