(2023)

What is the child allowance?

Child benefit and child allowance are tax reliefs for expenses incurred by parents due to their children. The entitlement to child benefit exists automatically from birth but must be applied for in writing. It is not the children who are entitled to the child benefit, but the parents or guardians responsible for the child's welfare.

Child Benefit

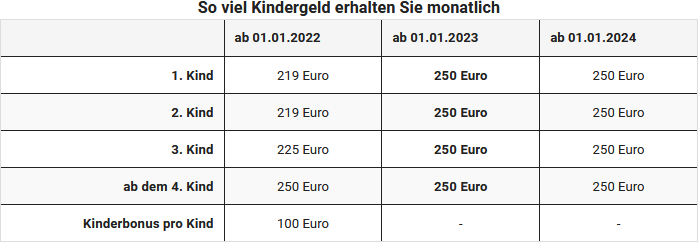

Child benefit is a monthly payment that parents usually receive from the family benefits office. Child benefit is not taxable. The amount of child benefit depends on the number of children.

Child Allowance

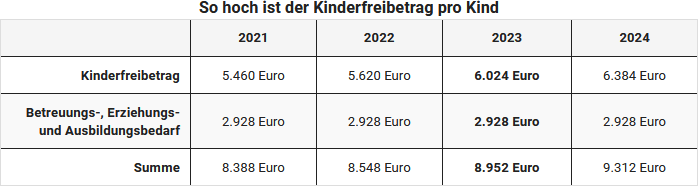

In contrast to child benefit, the child allowance is not paid out. The allowance is deducted from the taxable income, thus reducing the income tax. The child benefit already paid monthly is an advance payment on the child allowance. In 2023, the child allowance is 6.024 Euro for jointly assessed parents, otherwise 3.012 Euro per parent. The BEA allowance (for care, education, and training needs) is 2.928 Euro.

Child benefit and child allowance are linked. The tax office automatically determines which is more favourable for the taxpayer at the end of a tax year through a favourable assessment.

Entitlement to Child Allowance or Child Benefit

Parents are entitled to the child allowance from the birth of the child until the

- 18th birthday.

- 25th birthday if the child is still in education or training or doing voluntary service.

If the child is disabled and unable to support themselves, the entitlement to child benefit or child allowance is unlimited.

Bewertungen des Textes: Was ist der Kinderfreibetrag?

4.69

von 5

Anzahl an Bewertungen: 16