(2023)

Which relocation expenses can you deduct?

Whether you're acquiring a second home at your workplace or moving with your family – if your move is for professional reasons, the associated costs are deductible as work-related expenses. You don't need to change jobs or cities; it's sufficient if your daily commute is reduced by a total of one hour due to the move.

You can deduct proven costs for property searches, removals, redecorating, and possibly double rent payments until the end of the notice period for your old home. For moving trips with your own car, you can claim the kilometres travelled at a rate of 30 cents/km.

For smaller expenses such as tips for removal helpers or the installation of a fitted kitchen, there is a moving allowance. You can claim this in any case – even if you managed the entire move on your own. This is not possible for second household maintenance.

The Federal Ministry of Finance has recently increased the moving allowances as of 1 April 2022. Since 1 June 2020, moving allowances have been calculated slightly differently than before:

The day before the removal goods are loaded is decisive for determining the allowances.

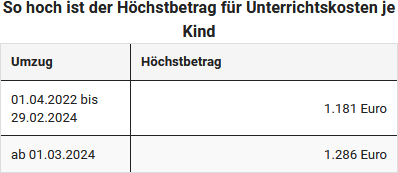

If tutoring is required for children due to the move, you can also deduct these costs from your taxes.

Bewertungen des Textes: Welche Umzugskosten können Sie absetzen?

3.33

von 5

Anzahl an Bewertungen: 3