(2023)

What is the deadline for submitting my tax return?

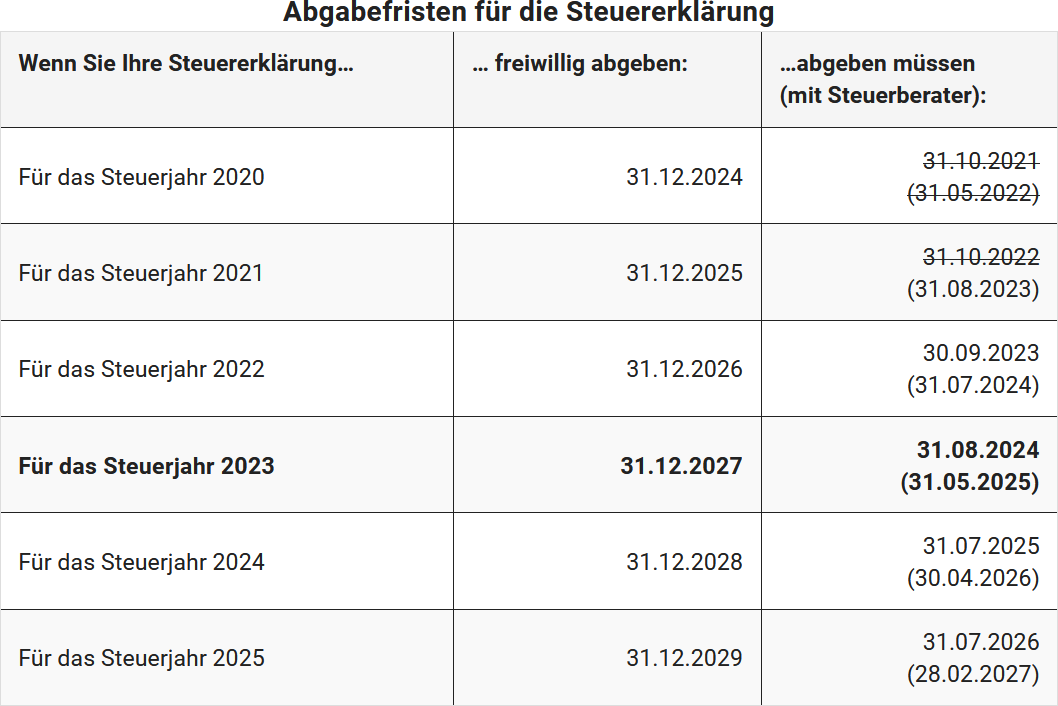

Since 2018, the submission deadlines have been legally extended by two months:

- For citizens who prepare their tax return themselves, the submission deadline is extended by 2 months from 31 May to 31 July of the following year (§ 149 para. 2 AO).

- Citizens who are advised by a tax advisor or income tax assistance association also receive two more months to submit their return. While under the previous "deadline decree" an extension beyond 31 December of the following year was only possible based on justified individual applications, there is now time until the end of February of the second following year.

But beware: The tax authorities have the option of the so-called advance request. You may therefore have to submit your tax return before the dates mentioned. In any case, high late fees are threatened for late submissions. Their imposition is no longer at the discretion of the tax officer but is mandatory.

Due to the significant burdens caused by the coronavirus pandemic, the deadlines for submitting income, corporation, trade, and VAT returns have been repeatedly extended, most recently by the "Fourth Coronavirus Tax Assistance Act".

1. Tax return 2020

For taxpayers who prepare their tax return themselves, the submission deadline was extended by 3 months from 31.7.2021 to 31.10.2021. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 6 months later, i.e. on 31.8.2022.

2. Tax return 2021

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 3 months from 31.7.2022 to 31.10.2022. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 6 months longer and ends instead of 28.2.2023 on 31.8.2023.

3. Tax return 2022

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 2 months from 31.7.2023 to 30.9.2023. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 5 months longer and ends instead of 29.2.2024 on 31.7.2024.

4. Tax return 2023

For taxpayers who prepare their tax return themselves, the submission deadline is extended by 1 month from 31.7.2024 to 31.8.2024. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 3 months longer and ends instead of 28.2.2025 on 31.5.2025.

5. Tax return 2024

For taxpayers who prepare their tax return themselves, there is no longer an extension. If the tax return is prepared by a tax advisor or income tax assistance association, the new submission deadline is 2 months longer and ends instead of 28.2.2026 on 30.4.2026.

Note: For the sake of completeness, it should be noted that the above deadlines are each postponed to the end of the next working day if they fall on a Sunday, a public holiday, or a Saturday. Example: 31 October 2022 is a public holiday in some federal states. Therefore, the deadline for submitting the 2021 tax return in these federal states is postponed to 1 November 2022.

Submission deadlines for the tax return

Apply for an extension

However, if you can foresee that your tax return will not be ready in the next few weeks, it is better to apply for an extension sooner rather than later. This application should actually be submitted before 31 July 2024 and there is no entitlement for the tax office to approve it. It is best to apply for a tacit extension; if you do not hear anything further, your application has been approved. It is important that you provide reasons for your request. These include, for example, a move, a business trip, illness, or missing documents. If the tax office accepts the extension, you usually have until 31 December 2025 at the latest.

Tax advisor ensures extension

If you have commissioned a tax advisor or income tax assistance association, you are in luck. The deadline is then automatically extended to 28 February 2025, unless the tax office explicitly requests an earlier submission. The reason for the later date is simple: it is unreasonable to expect tax experts to do all the work in the first five months of the year.

Eventually, a reminder will come

If you do not respond, the tax office will sooner or later send you a reminder and set a deadline. You should take this date seriously, otherwise, a compulsory fee may be imposed, and a hefty penalty for missing the deadline is also threatened. It is better to get in touch in good time.

Voluntary submissions have more time

If you are one of those who are not obliged to submit a tax return, none of this concerns you. The tax office does not expect money from you but probably has to refund some. For this very reason, however, it is a good idea not to put off the income tax return. Legally, you have plenty of time: for voluntary assessment, there are generally four years in which the tax return can (but does not have to) be submitted.

Your tax return for 2023 must therefore be received by 31 December 2027 – not a day later, otherwise all the work is for nothing. However, it is better not to exhaust the leeway but to take care of it early. Experience shows that it is easier to gather the necessary documents in the following year than three years later. Moreover, it is about money – who wants to wait four years for the refund?

Bewertungen des Textes: Bis wann muss ich meine Steuererklärung abgeben?

4.69

von 5

Anzahl an Bewertungen: 32