(2023)

What is the advantage of capping the church tax?

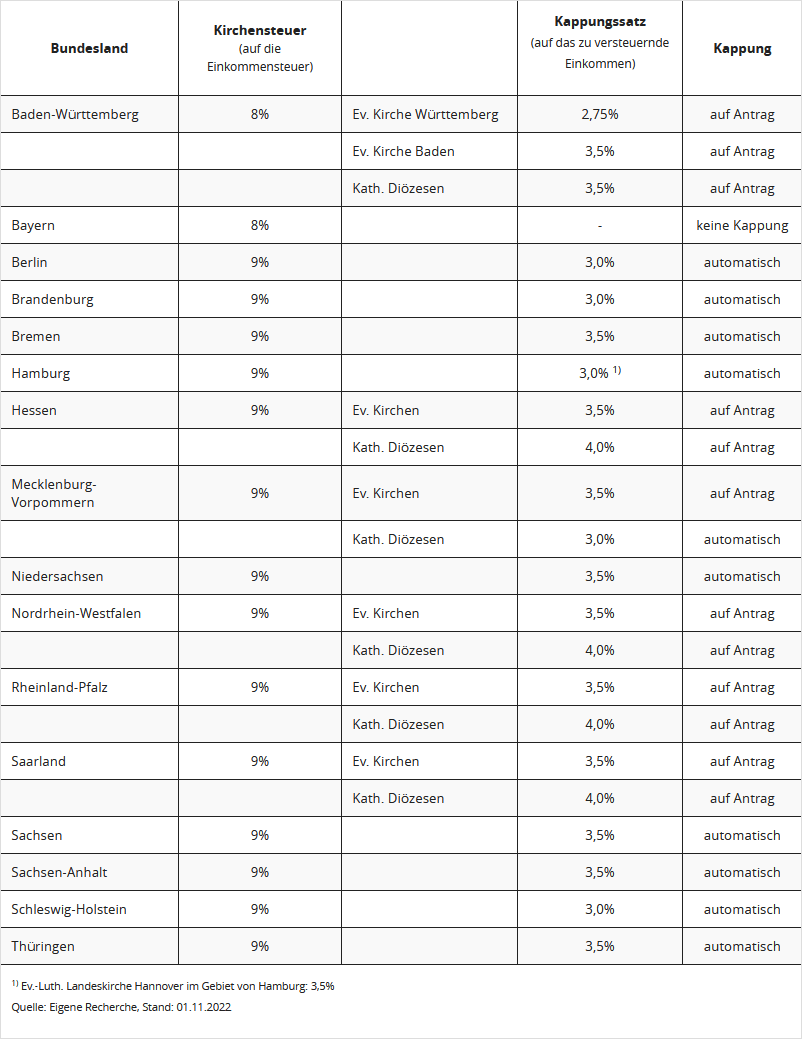

The amount of church tax depends on your place of residence. If you live in Bavaria or Baden-Württemberg, you pay 8 percent; in the other federal states, 9 percent. The basis is the assessed income tax. So you pay 9 percent of your income tax as church tax.

The higher your income, the higher the income tax and thus the higher the church tax. However, there is the option to apply for a cap on the church tax. This means: The church tax is no longer calculated based on the "income tax" but on the "taxable income". The capping rate varies between federal states and is between 2.75 and 4 percent of the taxable income.

Most church tax laws provide for a cap on income tax for high incomes. However, you should check whether the cap is granted automatically or only upon application in your federal state. There are different regulations:

- A cap without application is automatic in the federal states of Berlin, Brandenburg, Bremen, Hamburg, Mecklenburg-Western Pomerania, Lower Saxony, Saxony, Saxony-Anhalt, Schleswig-Holstein, and Thuringia.

- The cap only with application is available in Baden-Württemberg, Hesse, North Rhine-Westphalia, Rhineland-Palatinate, and Saarland.

- In Bavaria, no cap on church tax is possible.

Check whether a cap is already beneficial for your income. If so, submit an (informal) application for a cap on the church tax (plus a copy of the latest tax assessment) to your diocese or regional church.

In Berlin, a capping rate of 3 percent applies. So the church tax is limited to 3 percent of the taxable income.

2023 taxable income: 150.000 Euro

income tax payable under the basic rate: 53.027 Euro

church tax payable (9 percent): 4.772 Euro.

With a cap of 3 percent of the income, only 4.500 Euro church tax would have to be paid.

Bewertungen des Textes: Welchen Vorteil bringt die Kappung der Kirchensteuer?

5.00

von 5

Anzahl an Bewertungen: 1