(2022)

What does the opening clause mean?

With deferred taxation, there can be unfair over-taxation if a self-employed person has paid contributions to an occupational pension scheme over several years that were higher than the annual maximum contribution in the statutory pension insurance (sum of employer's and employee's share). The maximum amount to be paid is based on the contribution assessment ceiling.

This is recalculated annually and represents the limit up to which pension insurance contributions must be paid as a proportion of income. For income above the contribution assessment ceiling, you usually do not pay insurance contributions – unless you pay them voluntarily as in this context.

The self-employed person has therefore voluntarily paid additional contributions from their already taxed income. As a result, they have earned a higher pension, but on the other hand, they would have to tax it too highly with the usual tax rate. This can be avoided. As a pensioner, they can have their pension divided into a voluntary and a statutory part. However, they must have paid a higher voluntary contribution for at least ten years by 31.12.2004.

If this applies to you, you must apply for the portion of your pension based on these increased contributions to be taxed not at the high tax rate (2022: 82 percent of the pension) but at the significantly more favourable income share. The portion of the pension to be taxed at a lower rate is the opening clause, which you can find in the certificate from your pension insurance provider.

If you have been receiving a statutory pension of 1.500 Euro per month since the age of 65 and can prove to the tax office with a certificate from the pension payment office that 30 percent (this is the opening clause) of the pension payment is based on increased contributions, the following calculation applies:

For 70 percent of the pension: Normal taxation after deduction of the pension allowance: 1.500 Euro x 70 percent = 1.050 Euro x 12 months = 12.600 Euro minus pension allowance of (for example) 42 percent = 7.308 Euro.

For the part for which the opening clause of 30 percent applies, the more favourable income share is applied: 1.500 Euro x 30 percent = 450 Euro x 12 months = 5.400 Euro x 18 percent = 972 Euro. In this case, 8.280 Euro would have to be taxed. Without the opening clause, 10.440 Euro would have had to be taxed.

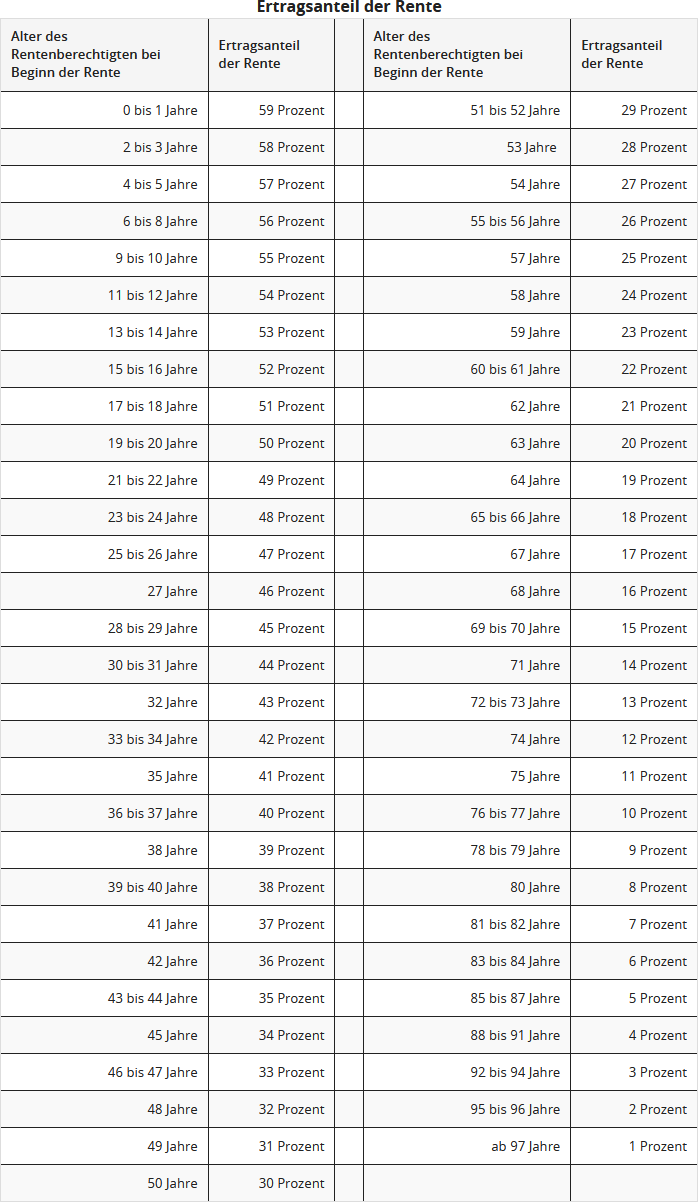

The income share depends on the age of the pensioner at the start of the pension payment, for example, it is 19 percent for 64-year-olds, 18 percent for 65 to 66-year-olds, and 17 percent for 67-year-olds.

The following table shows the amount of the income share depending on the age at the start of the pension; this is automatically calculated by SteuerGo:

At the end of May 2021, the Federal Fiscal Court published its two rulings on the possible double taxation of pensions. However, the claims of the affected pensioners were unsuccessful. The BFH considers double taxation to be possible only in a few individual cases. It considers the basic system of pension taxation to be lawful, i.e. the limited deduction of pension expenses during working life, combined with the partial tax exemption of pensions during the payout phase. Double taxation is only expected for later pension cohorts (BFH rulings of 19.5.2021, X R 33/19 and X R 20/21). However, the unsuccessful plaintiffs have lodged a constitutional complaint against the two BFH decisions (Ref. 2 BvR 1143/21 and 2 BvR 1140/21).

The issue is how double taxation is calculated in detail. The BFH has taken a very schematic view, which only leads to excessive taxation of pensions in individual cases. For the calculation of possible double taxation, the nominal value principle applies. In simple terms, the actual contributions paid and benefited from must be compared with the actual pension payments received and partially exempted. Neither amounts are to be discounted nor is inflation to be taken into account.

However, some experts, as well as the plaintiffs in case X R 33/19, argued that during the working phase, no pension amounts are acquired in cash, but rather pure pension points. The actual amount of the pension only becomes clear much later. But the BFH did not delve into the "depths" of financial and insurance mathematics, but rather compares amounts paid in with amounts paid out. Whether this is correct or whether there is a more favourable calculation for taxpayers is to be clarified by the constitutional judges in Karlsruhe.

Currently, the federal and state governments have finally been able to agree to issue affected tax assessments on a provisional basis regarding the disputed point. Specifically, tax assessments are issued provisionally regarding the "taxation of annuities and other benefits from basic provision under § 22 number 1 sentence 3 letter a double letter aa EStG". The provisional note is attached to all income tax assessments for assessment periods from 2005 in which an annuity or other benefit from the so-called basic provision is recorded (BMF letter of 30.8.2021, V A 3 - S 0338/19/10006 :001).

This means that pensioners will now receive income tax assessments with a note on the - partial - provisional nature of the tax assessment. If the Federal Constitutional Court finds that the current taxation of statutory pensions and pensions from occupational pension schemes and similar pension schemes is unconstitutionally high, the tax assessments issued now and in the future can be changed without a prior objection.