(2022)

What is the retirement relief amount?

The old-age relief amount can be used by pensioners who, in addition to income from pensions, also earn additional income or wages.

Additional income includes, for example:

- Income from renting,

- Capital assets,

- Income from self-employment,

- Income from private sales transactions,

- Income from a Riester pension.

However, the tax office first deducts various amounts (saver's allowance, income-related expenses allowance). The amount of the old-age relief depends on the pensioner's year of birth.

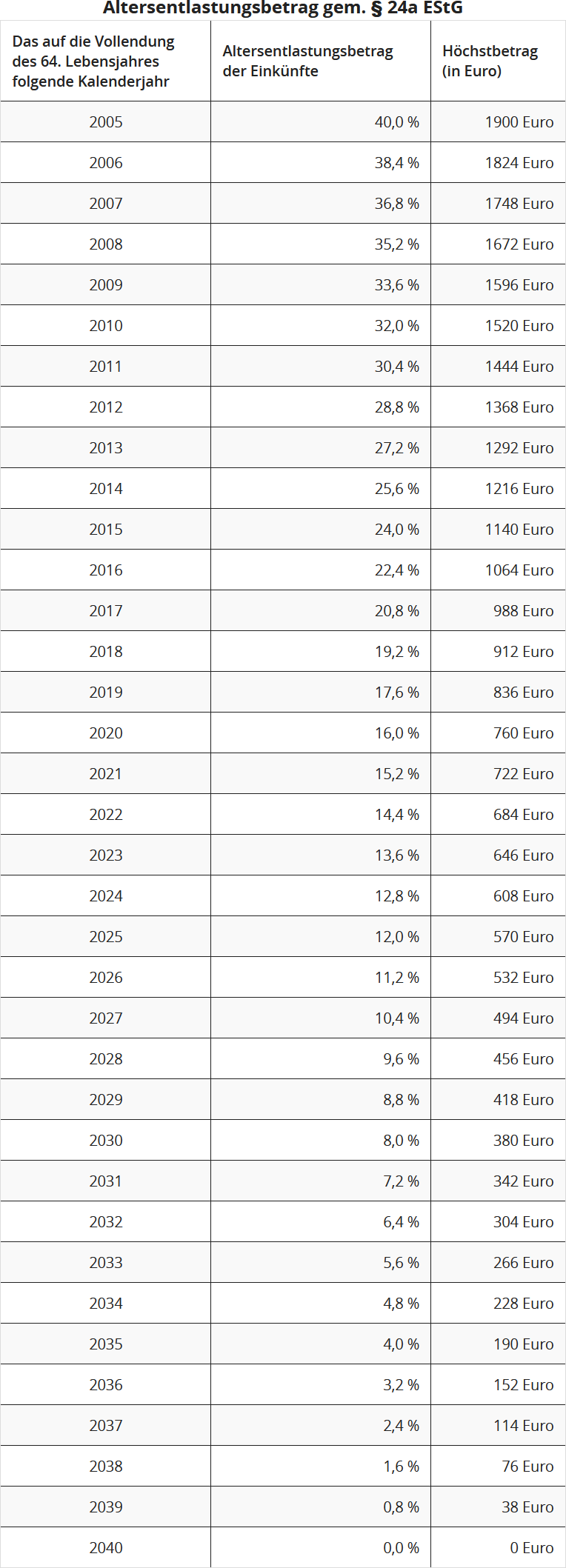

If you turn 64 in 2022 (born between 2.1.1958 and 1.1.1959), the old-age relief from 2023 is 13.6%, up to a maximum of 646 Euro.

The relevant percentages and maximum amounts for the old-age relief depend on the calendar year following the 64th birthday. These amounts are then fixed for life.