(2022)

Tax return for 2022: What's new

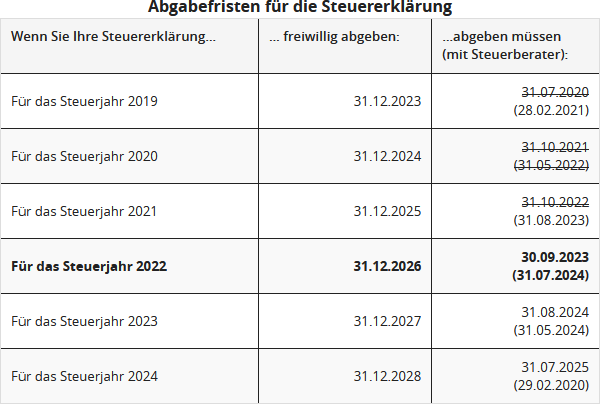

Submission deadline for the 2022 tax return

You are obliged to submit an income tax return if there is a specific reason. This is known as a mandatory assessment or official assessment.

If there is no reason for a mandatory assessment, employees, occupational pensioners and retirees can voluntarily submit a tax return (so-called application assessment in accordance with § 46 para. 2 no. 8 EStG). In this case, you have up to four years after the tax year to submit, for the 2022 tax return, until 31.12.2026 (§ 169 AO).

The following deadlines apply for submission:

Late submission penalty

Since 2019, new rules for imposing late submission penalties have been in effect, first applicable to the 2018 tax return. In addition to the previously unchanged "may rule", a "must rule" and a minimum late submission penalty have been introduced (§ 152 AO, amended by the "Act to Modernise Taxation Procedures" of 18.7.2016).

Lower tax interest rates retroactively from 1.1.2019

Retroactively from 1.1.2019, the interest rate for tax arrears and refunds was reduced to 0.15% per month, i.e. 1.8% per year.

The new interest rate for arrears and refund interest under § 233a AO is based on the current base rate under § 247 BGB (- 0.88% p.a.) with an appropriate surcharge of around 2.7 percentage points. The interest rate is to be reviewed at least every three years and adjusted for subsequent interest periods.

Obligation to submit if receiving short-time work benefits

In response to the Corona crisis, the regulations regarding the receipt of short-time work benefits were changed several times. The duration for receiving short-time work benefits was extended to up to 24 months. There are also special regulations for the tax treatment of employer subsidies for short-time work benefits and seasonal short-time work benefits. But what do these regulations mean for the tax return?

Individuals who receive more than 410 Euro in short-time work benefits in the calendar year are obliged to submit a tax return. Those who do not submit the return "voluntarily" should be aware that the tax offices receive information about the receipt of short-time work benefits via data exchange, may request the tax return after one or two years, and significant late submission penalties may apply.

Supplementary amounts are also subject to the progression clause (§ 32b para. 1 no. 1g EStG). The employer must enter them in the electronic payslip (for the calendar year 2020) under number 15.

Tax relief: Increase in basic allowance

The tax basic allowance ensures that the portion of income absolutely necessary for living expenses is not taxed (minimum subsistence level). On 1.1.2023, the basic allowance was increased from 10.347 Euro to 10.908 Euro. A further increase to 11.604 Euro is expected on 1.1.2024 (§ 32a EStG).

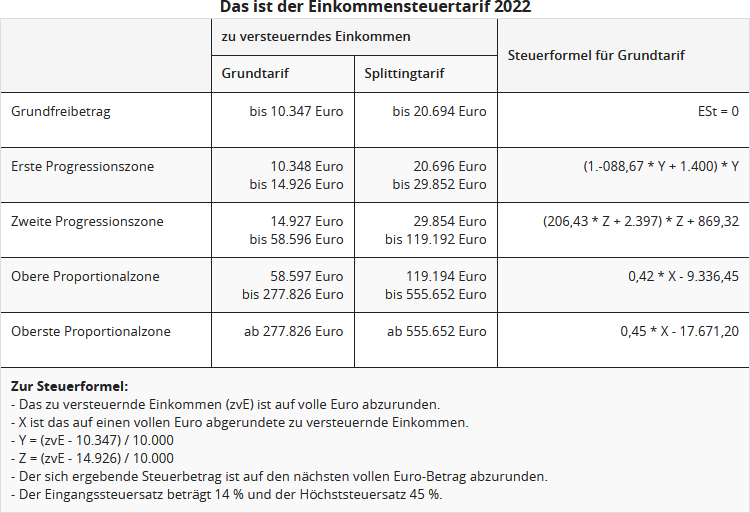

Reduction of fiscal drag

To offset fiscal drag and prevent a creeping tax increase, the key values of the 2022 tax rate are increased by the estimated inflation rate, i.e. "shifted to the right", by 1.17 percent (2021:1.52 percent).

This adjustment means that rising tax rates of the progressive tax rate apply only at slightly higher income levels, leaving more net income. Without this adjustment, taxpayers whose income only increases by the inflation rate would pay more tax on average and have less net purchasing power.

The new income tax rate 2022

Wealth tax applies only at higher income

Since 2007, there has been the so-called wealth tax, a tax surcharge of 3 percentage points for top earners. The top tax rate is therefore 45% in the highest proportional zone and applies to taxable income from 2019 of 265.327 Euro or 530.653 Euro (single / married).

In 2021, the highest proportional zone with the tax surcharge of 3 percent begins at a taxable income of 274.613 Euro for singles and 549.225 Euro for married couples. From 2022, the highest proportional zone begins at a taxable income of 277.826 Euro or 555.651 Euro.

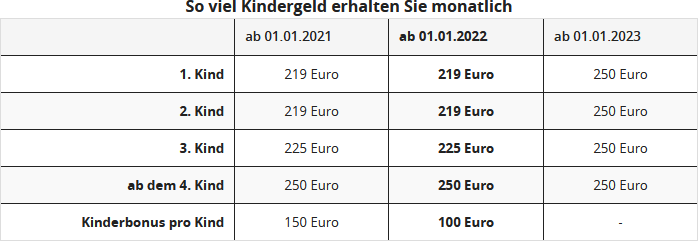

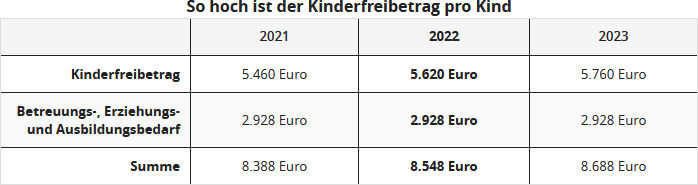

Family support: Increase in child benefit and child allowance

Child benefit was last increased in 2021. Already for 2022, the child allowance was retrospectively increased from 2.730 Euro to 2.810 Euro per parent. The education allowance (allowance for care and education or training) remains at 1.464 Euro per parent as in 2021. Further increases in the child allowance are planned for 1.1.2023 and 1.1.2024 ("Inflation Compensation Act").

To provide special support for families, child benefit will be increased to 250 Euro per month for the first three children from 2023. The increase is to take effect from 1 January 2023. For the first and second child, this means an increase of 31 Euro per month, for the third child an increase of 25 Euro per month. In the long term, child benefit in Germany is to be replaced by a basic child allowance, which would bundle various family benefits.

Current: With the "Tax Relief Act 2022", a one-off child bonus of 100 Euro was paid in July 2022 in addition to child benefit for each child.

Relief amount for single parents

Since 2004, single parents have been entitled to a relief amount if at least one child for whom they receive child benefit or the tax child allowance belongs to their household, and no other adult lives in the household (§ 24b EStG). The aim of the relief amount is to compensate for the higher costs of living and running a household for "genuinely" single parents who share a household only with their children and no other adult who actually or financially contributes to the household.

Since 2020, the relief amount for single parents has been permanently increased to 4.008 Euro. The increase of 240 Euro for each additional child remains unchanged (§ 24b para. 2 sentence 3 EStG, amended by the "Second Corona Tax Assistance Act").

Energy price allowance (EPP) for employees and mini-jobbers

The energy price allowance of 300 Euro should have already been paid out in September 2022 via the employer's payroll. Employees who are not employed in September 2022 can receive the EPP by submitting an income tax return.

If a tax return is submitted and the eligibility requirements for the energy price allowance are met, the EPP will be automatically set with the 2022 income tax assessment. No special application is required. This also applies to all mini-jobbers whose employers did not pay the EPP with their wages.

Mini-job limit rises to 520 Euro

On 1.10.2022, the statutory minimum wage was increased to 12 Euro per hour. Accordingly, the earnings limit for mini-jobs was raised from 450 Euro to 520 Euro. A mini-jobber may therefore earn 6.240 Euro over 12 months and in justified exceptional cases up to 7.280 Euro per year.

Employee allowance increases to 1.200 Euro

With the "Tax Relief Act 2022", the employee allowance was increased retroactively from 1.1.2022 from 1.000 Euro to 1.200 Euro (§ 9a no. 1 EStG). If you do not claim individual work-related expenses, an amount of 1.200 Euro will be assumed without proof from 2022.

Increase in travel allowance for long-distance commuters

The allowance for long-distance commuters has been increased again, to 38 cents from the 21st kilometre. For the first 20 km, it remains unchanged at 30 cents. This applies retroactively from 1.1.2022. Originally, the increase was to apply from 2024, but it has now been brought forward. The increase is initially limited until 31.12.2026.

Home office allowance tax deductible

Employees who work from home and whose workplace does not meet the tax requirements for a home office can claim a flat rate of 5 Euro per day as work-related expenses. The home office allowance is limited to a maximum of 600 Euro per year.

Important: Although the tax offices are instructed not to request employer certificates for the number of home working days, those who claim high travel expenses for commuting despite the allowance should expect enquiries from their tax office.

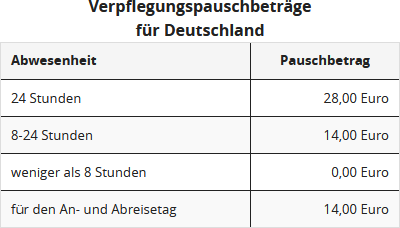

Increase in meal allowances

Since 1.1.2020, the meal allowances have been increased (§ 9 para. 4a sentence 3 EStG, amended by the "Act on Further Tax Promotion of Electromobility and Amendment of Other Tax Regulations" of 12.12.2019).

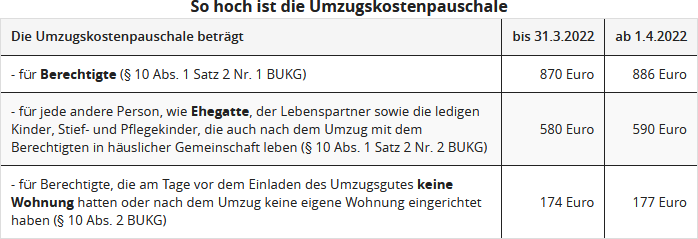

Work-related relocation: Increase in allowances

If you move for work-related reasons, you can deduct the moving costs as work-related expenses or have them reimbursed tax-free by your employer. These include transport costs, travel expenses, double rent payments, estate agent fees for a rented flat and other moving expenses. While the first-mentioned costs can be deducted in the proven amount, other moving expenses can be claimed with a flat rate.

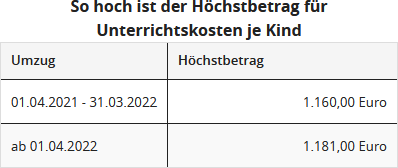

If the children have difficulties at school as a result of the move, you can deduct "expenses for additional tuition for the children" up to a certain maximum amount as work-related expenses (§ 9 para. 2 BUKG 2019).

Pension from statutory pension insurance

For pensioners who received a pension for the first time in 2022, the taxable portion is 82% of the pension amount. The gross pension amount is 82% taxable, with a work-related expenses allowance of 102 Euro deducted.

In the following year 2022, the full annual amount of the pension will again be taxed at the taxable rate of 80%. The remaining portion of the pension is then your personal pension allowance, which will apply in the same amount for the entire duration of the pension. From 2023, the full annual pension amount will be taxable after deduction of the pension allowance and the work-related expenses allowance of 102 Euro.

Pensions and occupational pensions

Remuneration is - unlike pensions from statutory pension insurance - fully taxable as "income from employment" and must therefore be declared in "Anlage N". Remuneration has been subject to the pension allowance, the supplement to the pension allowance and the work-related expenses allowance of 102 Euro since 2005.

If you retire in 2022, the pension allowance for you is 14.4% of the remuneration, up to a maximum of 1.080 Euro, and the supplement to the pension allowance is 324 Euro. Together with the work-related expenses allowance of 102 Euro, the remuneration is therefore tax-free up to 1.506 Euro - for life.

Health insurance: Higher thresholds for family insurance

In statutory health and nursing care insurance, family members are co-insured free of charge if their total income does not regularly exceed one seventh of the monthly reference amount per month. As the reference amount usually changes annually, the income limit for the free insurance of family members in statutory health insurance also changes. The income limit for family insurance is generally 470 Euro per month in 2022.

The income limit may be exceeded three times a year without losing the free family insurance. This limitation will be lifted and the regulation extended indefinitely. If the income limit is exceeded several times, it is possible to take out voluntary insurance in the statutory health insurance.

Tax relief for charitable organisations

For donations to help those affected by the Corona crisis - regardless of the amount - the simplified donation receipt is sufficient. This is intended to reduce the administrative burden for the supported organisations. (BMF decree of 9.4.2020, IV C 4 -S 2223/19/10003).

Donations to support refugees and those left behind in the Ukraine war are for charitable purposes. Donations are deductible as special expenses, up to 20% of the total income. Donations exceeding this limit can be carried forward to the following year and taken into account there within the limit. This donation carryforward is unlimited in time (§ 10b para. 1 no. 1 EStG).

In principle: No tax relief without a donation receipt! Donations must always be proven with a formal donation receipt in the officially prescribed form in order to obtain the desired tax deduction. However, for donations to refugees, a simplified donation receipt applies from 24.2. to 31.12.2022. In the case of donations in the event of a disaster, the cash deposit slip or the bank's booking confirmation, e.g. account statement, direct debit slip or PC printout in the case of online banking, is sufficient. The amount of the donation does not matter.

Support for dependants: Increase in maximum maintenance amount

On 1.1.2022, the maximum maintenance amount was increased to 10.347 Euro. The maximum maintenance amount is often not granted at this level, but is reduced. Namely by one twelfth for each full calendar month in which the conditions are not met, by the recipient's own income and benefits that exceed the allowance of 624 Euro, and by one, two or three quarters if the recipient lives in a country with a lower standard of living.

Bewertungen des Textes: Steuererklärung für 2022: Das ist neu

4.74

von 5

Anzahl an Bewertungen: 78