(2022)

How are child benefit and the child allowance related?

For the allowances, the same conditions apply as for the entitlement to child benefit: there must be a parental relationship, the child must belong to your household and be under 18 or meet the conditions for the extended entitlement to child benefit.

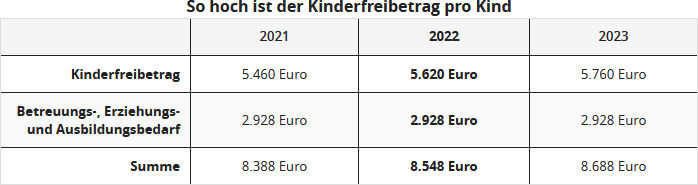

The annual child allowance for parents who are jointly assessed for tax purposes is 5,620 Euro in the year 2022, and the BEA allowance (for care, education and training) is 2,928 Euro. Thus, parents are entitled to a total allowance of 8,548 Euro per child for the tax year 2022. For separately assessed or single parents, each parent is entitled to half of the allowance.

Favourability test

These allowances are only granted as part of the tax assessment if the tax saving from the allowances is higher than the child benefit, whereby the entitlement to child benefit and not the actual child benefit received is decisive. However, you do not have to calculate this yourself. The tax office does this, and in tax language, this process is called the favourability test.

Note: In practice, there are numerous cases where child-related benefits are not granted because there is an "entitlement to child benefit" to be credited, but this has not actually been paid. And above all: Since the retroactive payment of child benefit has also been legally limited to six months, it is often no longer possible to realise the child benefit retrospectively. In other words, parents who forgot to apply for child benefit in time, even though they were entitled to it, are more or less left empty-handed under the current legal situation, as the "entitlement to child benefit" is credited.

As a result, the children's subsistence level is taxed. However, there is currently light at the end of the tunnel: Very hidden in the "Act Against Illegal Employment and Benefit Fraud" is a legal change affecting child-related benefits in income tax. Due to an amendment to § 31 EStG, it is now no longer the entitled but the paid child benefit that counts if the child benefit was applied for too late and therefore not paid. Those affected can then at least benefit from the allowances in the tax assessment.

Bewertungen des Textes: Wie hängen Kindergeld und Kinderfreibetrag zusammen?

3.84

von 5

Anzahl an Bewertungen: 138