(2022)

Do I receive the same amount of child benefit for all children?

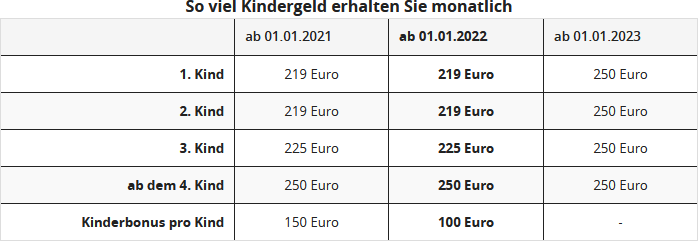

If you have more than one child, you do not receive the same amount of child benefit for each child. The entitlement to child benefit is as follows:

Child benefit is paid for children up to the age of 18. The child's income is irrelevant.

The entitlement continues for children over 18 until their 25th birthday, as long as they are in education or doing voluntary service. Child benefit is paid by the family offices of the Federal Employment Agency. Public sector employees or pension recipients receive the money from their employers.

A child for whom you do not receive child benefit yourself can be counted as a so-called Zählkind to increase the child benefit entitlement for your other children. For example: A couple has three children together, and the husband also has a child from a previous relationship. The child lives with their biological mother, who also receives child benefit.

If the second wife now names her husband as the beneficiary, his first child can be counted as a Zählkind. The couple will not receive child benefit for this child, but the other children will be counted as the second, third, and fourth child. Over the year, the family receives 372 Euro more in child benefit.

Note: The Federal Fiscal Court has ruled on so-called Zählkinder in the context of non-marital partnerships as follows: If the parents of a joint child live together in a non-marital partnership and two older children from another relationship of one parent are also living in their household, the other parent does not receive the increased child benefit amount for a third child according to § 66 (1) EStG for the joint child (BFH ruling of 25.4.2018, III R 24/17).